Cards

How to apply for Itaú Samsung card

Find out how to apply for your Itaú Samsung card and get access to exclusive discounts, installments up to 24 times and international coverage.

Advertisement

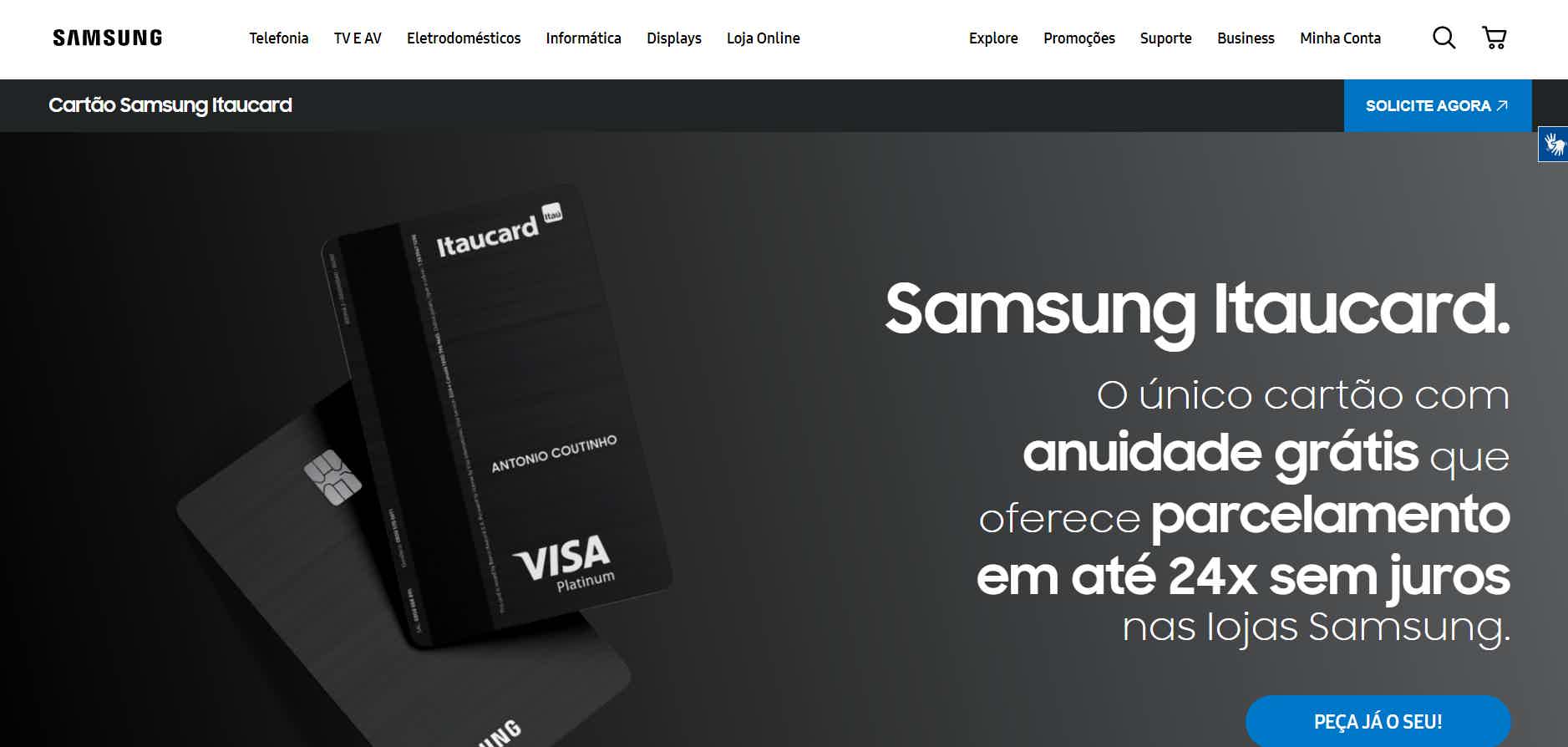

Itaú Samsung Card: online request 100%

If you are a frequent customer of Samsung stores, the Itaú Samsung card is the best alternative financial product for you. This is because, through this card, you can pay your purchases in up to 24 installments, get several discounts and also have access to a digital account.

So read on to see how the application process works.

Order online

So, to apply online, you just need to enter the official website of Banco Itaú. Then choose the card you prefer. After that, fill in your personal data and then wait for your credit analysis to respond.

But, it is important to mention that you must prove a minimum income of R$800 to apply for the card.

Therefore, this financial product is one of the best cards on the market and, in addition, it has a very quick and simple application.

Request via phone

Well, unfortunately, it is not possible to apply for a credit card over the phone, but you can contact the Itaú Customer Service Center to resolve all your doubts using the following numbers:

- 4004 4828 (capitals and metropolitan areas);

- 0800 970 4828 (other locations).

Request by app

So, it is not possible to request the Itaú samsung card through the application, but you can access the Samsung Pay application to access all your credit card transactions.

And, in addition, you can start using the application even before your Itaú Samsung physical card arrives at your home.

Therefore, the Itaú Samsung card is among the best cards on the market because it has exclusive conditions for customers.

Santander SX card or Itaú Samsung card: which one to choose?

Well then, if after knowing a little about the card you still have doubts, don't worry, as today we brought you a comparison of the Santander SX card with the Itaú Samsung card. Thus, you will have more information to decide which one is the ideal financial product for your daily life.

| Santander SX Card | Itaú Credicard Card | |

| Minimum Income | R$ 500.00 for account holders R$ 1,045.00 for non-account holders | R$ 800.00 |

| Annuity | 12x of R$ 33.25. | Exempt |

| Flag | Visa/Mastercard | Visa |

| Roof | International | International |

| Benefits | International Card Go with Visa/Mastercard Surprise Possibility of exemption from annuity | international coverage Go from Visa exempt annuity free digital account |

How to apply for the Santander SX card

The Santander SX card is international and has several advantages, such as the possibility of exemption from the annuity. Find out how to order yours here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Access Card or Protest Card: which one to choose?

Want to decide between access card or protest card? Because both have an international flag and accept negatives. Learn more about them here!

Keep Reading

How to send resume to Burger King? Check it out here

Find out how to send your resume to Burger King and see how you can access the different opportunities this company offers!

Keep Reading

Get to know Bari real estate credit

With Bari real estate credit you have up to 240 months to pay. It also finances 70% of the value of your property. Check the details here!

Keep ReadingYou may also like

How to make a card in Portugal without fees

So, are you looking for a credit card option in Portugal without fees? The search is over! We separate here a list full of options for you to choose from, see!

Keep Reading

Discover the free Caixa TEM card

With the free Caixa TEM card, you are guaranteed exemption from annuity and administrative fees, as well as several other benefits. Keep reading and check out everything about the card.

Keep Reading

How to apply for the Samsung Platinum Card

Samsung Platinum card is free of annuity and can be very advantageous! Click and find out more about it and how to order yours.

Keep Reading