loans

Discover the Nexoos business loan

The Nexoos business loan is a great line of credit for your business, with low interest rates and no bureaucracy. Find out more here!

Advertisement

Nexoos business loan: high borrowing rate and low interest

The Nexoos business loan is the perfect credit opportunity for small and medium-sized businesses looking for low-interest financing.

Therefore, if you want to know more about the loan and evaluate whether it is the solution to your problems, continue reading and check it out!

How to apply for the Nexoos loan

The Nexoos loan could be the solution you are looking for to pay off your company's debts and grow again. Want to know how to request? Check it out here!

How does the Nexoos business loan work?

In principle, the loan works through a digital platform. In other words, you register on the company's official website and complete the entire process there. Furthermore, financing is done through investors who believe in your company and want to help you reach the desired value.

So, to apply for credit, you must have all the necessary documentation on hand for the analysis to be carried out. Therefore, only small and medium-sized companies can apply for a loan. Therefore, if your company does not fit into these categories, your application will not be accepted.

What is the Nexoos business loan limit?

So, your loan limit can vary between R$15,000.00 and R$500,000.00, but this depends on the credit analysis.

Therefore, after your proposal is accepted, you must wait for the fundraising round until the approved amount is received.

Is Nexoos business loan worth it?

First of all, if you're not sure whether this line of credit is what you need, let's discuss some important points so you can make a well-informed decision.

Therefore, despite being a loan without bureaucracy, there are some criteria required by Nexoos for your company to make the request. Are they:

- have at least 12 months of active CNPJ;

- have an annual turnover of more than R$500,000.00;

- not have relevant restrictions on the name of the company or partners;

- not be MEI.

So, if your company meets all these requirements, it's worth taking out a Nexoos business loan. After all, it is a reliable company, supervised by the Central Bank to operate as a People-to-People Loan Company.

Furthermore, the amounts available, in addition to the low interest rates and flexibility in paying installments, make this loan a very attractive option for those who need money to boost their business.

How to take out a Nexoos business loan?

Well, now we're going to show you how simple it is to apply for your business line of credit, so you can boost your company the way you always wanted.

Firstly, you need to access the company's official website and request the amount you need, as well as the payment term you want. During this first stage, it is necessary to register with your personal data and company details.

Your order then goes through a credit analysis and, if approved, Nexoos sends you a commercial proposal informing the amount and installments to be paid. Furthermore, in this part of the process it is necessary to send all the documentation required by the fintech correctly so that the process is not interrupted.

With the documentation in order, the fundraising round begins. In other words, Nexoos makes your company available on the digital platform and interested investors provide financing. Finally, when your company reaches the requested amount, you sign the digital contract and the money will be in your account within two business days. Simple, right?

Therefore, if you want to know how to apply for a Nexoos business loan, check out the recommended content below so you don't miss any details!

How to apply for the Nexoos loan

The Nexoos loan could be the solution you are looking for to pay off your company's debts and grow again. Want to know how to request? Check it out here!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to get a part-time job?

Wondering how to get a part-time job? In today's article we will show you how it works and how to have one. Check out our tips!

Keep Reading

Is it possible to withdraw money without a card?

Did you know that it is possible to withdraw money without a card? In this article, we will show you how this process works. Read it now and check it out!

Keep Reading

Mercado Pago Card or Ourocard Universitário Card: which one to choose?

Either the Mercado Pago Card or the Ourocard Universitário Card, both have international coverage and have the Visa flag. Compare here!

Keep ReadingYou may also like

Good Loan for Online Credit: great credit offers for you

Need quick cash to catch up on your finances or make one-off purchases? Then the Good for Credit loan can be a great option for you. To know more about him, just continue reading.

Keep Reading

Partner Magalu: how to make extra income

Get to know the Parceiro Magalu platform, created to help retailers and freelancers earn extra income. Learn more in our article.

Keep Reading

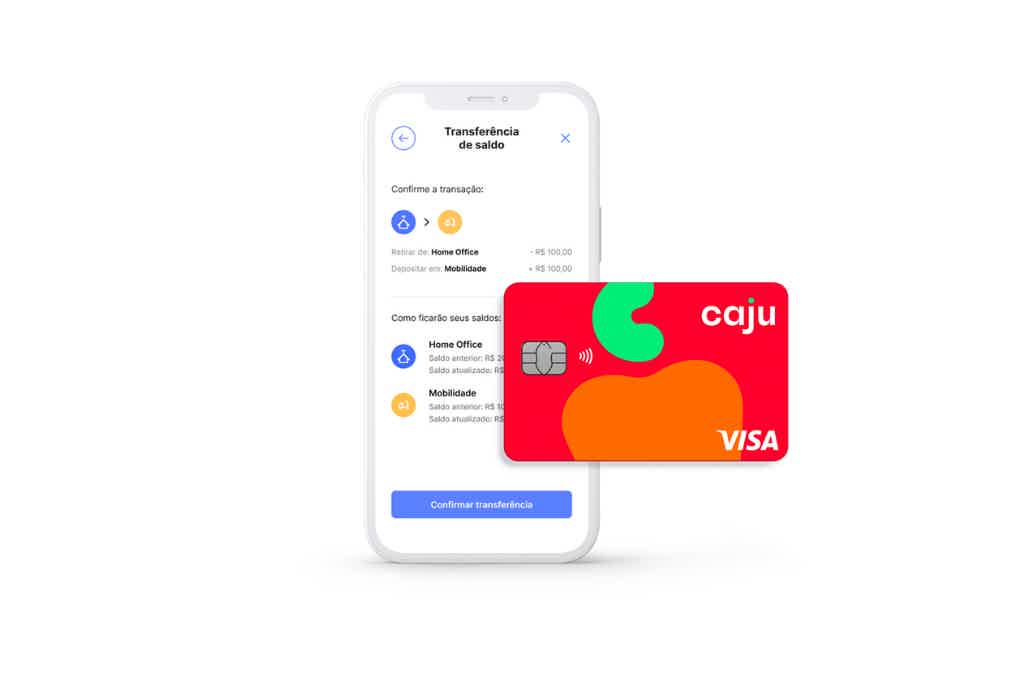

How to apply for the cash card

The Caju card is national with the Visa flag, so it is a complete option to unify the benefits of your employees. Plus, it's free and accepted in thousands of places. To find out how to apply, just continue reading below!

Keep Reading