loans

Click Cash personal loan: what it is and how it works

The Click Cash personal loan is the perfect line of credit for those who need financial assistance without bureaucracy. This is because it offers a credit of up to R$ 10,000 with a payment period of up to 24 months. Want to know more? Check out!

Advertisement

Click Cash: up to R$ 10k with an interest rate of up to 14.9% per month

First, Click Cash is a fintech founded in December 2019 with the mission to offer a personal line of credit in a digital and secure way.

Therefore, if you need fast cash without bureaucracy, this loan may be the ideal product for you.

So, do you want to know more about the characteristics of credit? Check out the content below!

| click cash | |

| Minimum Income | not informed |

| Interest rate | From 4.0 to 14.9% per month |

| Deadline to pay | From 6 to 24 months |

| release period | one business day |

| loan amount | From R$1,000.00 to R$10,000.00 |

| Do you accept negatives? | No |

| Benefits | Fast money and no bureaucracy Everything done online 100% First installment in 45 days |

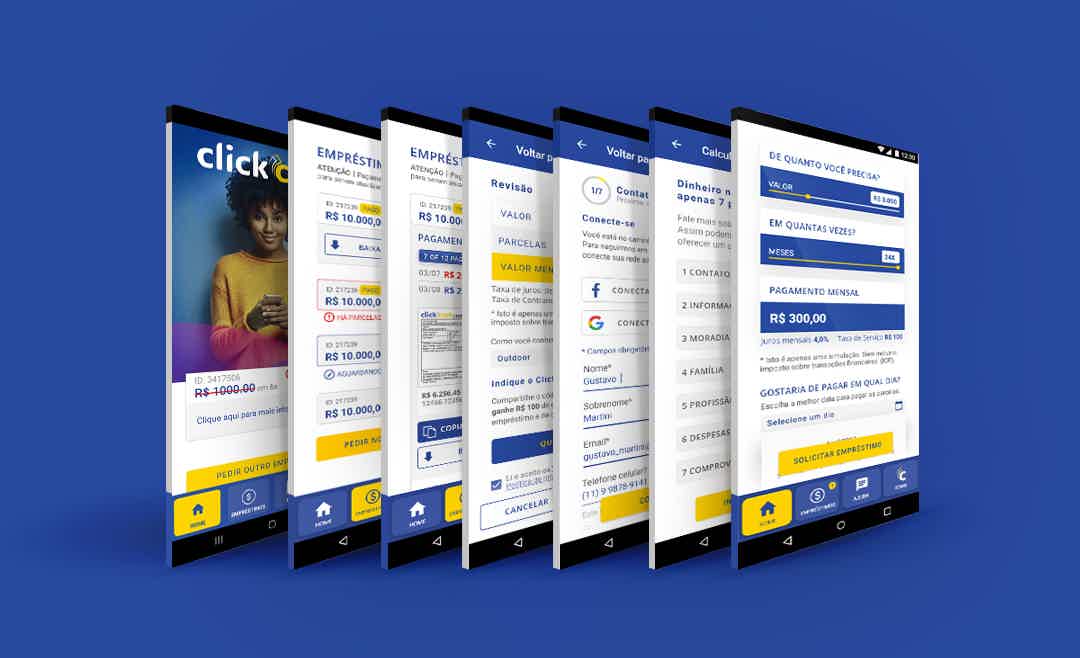

How to apply for the Click Cash loan

The Click Cash loan is the ideal option for those who need quick cash without bureaucracy! Want to know how to apply? Check out!

Click Cash Advantages

In this sense, the first positive point that stands out is the ease of use. That is, the request is made through the application and can also be followed there. Which means more practicality and less bureaucracy.

In addition, Click Cash has its own credit analysis system that uses your Positive Registration with the SPC/Serasa. That way your proposal is analyzed in seconds. Therefore, the loan is a great option for those who need quick cash.

Even more, if after the credit analysis your loan is approved, the money falls into your account within one business day.

Key Features of Click Cash

So, the main characteristic of the loan is that it is a completely digital process. That is, everything is done through the application. What's more, the response to your request is immediate, so you don't have to worry about a long review period.

Along with speed, payment flexibility is an added attraction, as you can pay your personal credit in up to 24 installments with the first payment in 45 days.

Furthermore, interest rates vary from 4.0% to 14.9% per month, and this amount is defined after the initial analysis of your profile.

Who the loan is for

Therefore, Click Cash is the ideal loan for anyone looking for quick and simple financial assistance.

In addition, you must be over 21 years old and have no restrictions with the SPC/SERASA to apply for your line of credit.

So, do you want to know a little more about the loan? Continue reading through the recommended content.

Discover the Click Cash personal loan

The Click Cash loan is the ideal solution to your financial problems or to make an investment. Find out more here!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Agibank loan or Caixa loan: which is better?

Need a quick loan? Check our content on Agibank loan or Caixa loan and choose!

Keep Reading

Card Review Casas Bahia 2021

Check out the Casas Bahia card review and see how this financial product can help you make your purchases more economical and secure.

Keep Reading

How to apply for Bradesco Reforma

If you dream of renovating your home, Bradesco Reforma Imóveis may be the ideal line of credit for you! Check here how to apply.

Keep ReadingYou may also like

How to apply for Citi Prestige Card

Do you want to have a luxury card that offers exclusivity and benefits for travelers, in addition to full assistance? So, see how you can apply for your Citi Prestige Card here.

Keep Reading

How to get Sick Pay

Finding out how to get Sickness Benefit is essential to quickly apply for your benefit. To find out how to secure yours, just continue reading the article!

Keep Reading

How to know Nubank card password?

You know that moment when you forgot your card password and you urgently need to use it to make a purchase? No problem. Knowing the process of changing the Nubank card password or seeing it in the app will resolve this impasse in a moment. Want to know more about how passwords work and how to change them if necessary? Come with us!

Keep Reading