Construction Credit

How to apply for Creditas Reforma credit

Do you want to renovate your property with freedom to spend your money? The Creditas Reforma credit could be ideal for you! So check here how to apply.

Advertisement

Creditas Reforma: loan with property guarantee of up to 3 million

Well, Creditas Reforma credit is an online platform where you can apply for a loan to finance your retirement. First of all, offering your property or vehicle as collateral to get lower interest rates and greater flexibility in payments.

Furthermore, now that you know a little more about the loan, we will show you how to apply for the service through Creditas channels. Continue reading and check it out!

Order online

Well, to apply for your Creditas Reforma credit, you need to access the official website of the company. Then choose which secured loan is right for you. In addition, you need to do the simulation, filling in your name, email and desired value. After a credit analysis, Creditas will contact you to offer you the best proposal.

Request via phone

However, it is not possible to apply for a loan over the phone. But you can contact the Creditas Relationship Center through the following numbers:

- (11) 3164 1402 (São Paulo);

- 4003 1586 (other capitals and metropolitan regions);

- 0800 721 8547 (other locations – landline only).

It is worth noting that the service is from Monday to Friday, from 08:00 to 20:00.

Request by app

Well, applying for Creditas Reforma credit through the app is very simple. To do this, just download the Creditas app from the App Store or Google Play and register. In the application you have access to all the site's tools in the palm of your hand. In this way, you further simplify the loan application process and get closer to fulfilling your dreams.

Bradesco Reforma credit or Creditas Reforma credit: which one to choose?

However, if even with all the information you are still not sure if Creditas Reforma credit is the best option for you? Well, check out the table below comparing it with Bradesco Reforma to help you with that decision.

| Bradesco Reforma | Reform Credits | |

| Minimum Income | On request | Uninformed |

| Interest rate | Less than 1% per month | From 0.99% for vehicles and 0.79% + IPCA for real estate |

| Deadline to pay | Up to 25 years | Up to 180 months depending on the loan |

| Where to use the credit | Purchase of building materials | Purchase of construction materials, hire labor and various renovation services. |

| Benefits | lower interest rate Up to 2 years to complete the work High amount of financing | Online 100% Service low interest rates payment flexibility |

How to Apply for Bradesco Reforma

If you dream of renovating your home, Bradesco Reforma Imóveis may be the ideal line of credit for you! Check here how to apply.

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Is it worth opening a BV account?

Want to know if it's worth opening a BV account? In today's article we will show you all the features and advantages of this account. Check out!

Keep Reading

How much score do I need to finance a motorcycle?

How much score do I need to finance a motorcycle? In this article we will answer that and also give you tips to increase your score. Check out!

Keep Reading

Check out how to earn income above 1700 reais

If you need a job, read here and find out how much a mechanic earns and all the details to be able to stand out in this job.

Keep ReadingYou may also like

Free Programming Course: Where and How to Do It

Do you want to work in the area of programming? So check out some free programming courses in this post!

Keep Reading

How to open account at Crypto.com brokerage

To invest in cryptocurrencies safely, nothing better than having a safe and respected broker like Crypo.com. Check then how to open your account on this exchange.

Keep Reading

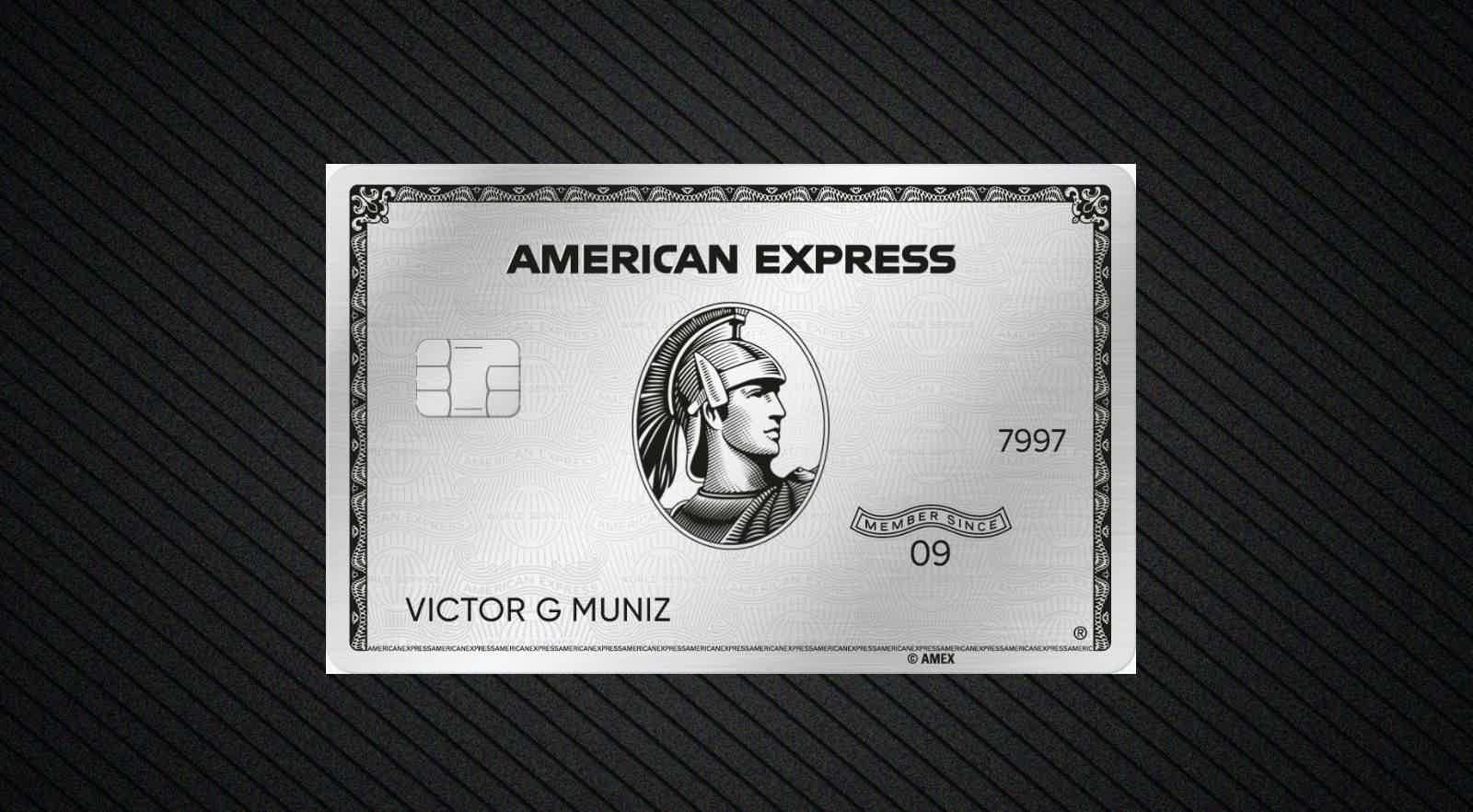

How to apply for The Platinum Card

With so many benefits, it's hard not to want to have The Platinum Card to call your own. So, if you are interested, you are in the right place, because here you will know the entire application procedure. Read more.

Keep Reading