loans

Discover the uConecte personal loan

The uConecte personal loan is approved in a few hours and is ideal for those who need money quickly. Check more here!

Advertisement

uConecte: quick loan

uConecte is a loan platform that offers various types of credit according to your needs. And today we are going to present the uConecte personal loan!

So, if you need money quickly to deal with financial emergencies or to take an unexpected trip, it could be the right choice for you.

So, continue reading and learn more about this opportunity!

How to apply for the uConecte loan

The uConecte loan is perfect for those who need money quickly, with approval in a few hours. Find out how to order yours!

How does the uConecte personal loan work?

Well, personal credit works easily and simply, as you can contract it directly through the app.

Furthermore, you can do a simulation with the required value. This way, you receive credit proposals and choose the one that best fits your current financial life.

Furthermore, the company provides all information transparently, so that you do not have any surprises when paying off your debt. This way, you know all the deadlines and amounts to be paid.

What is the uConecte personal loan limit?

So, the limit will vary depending on the customer.

This way, you will simulate your loan and receive some proposals according to your profile. After that, just choose the one that best suits your financial needs.

However, it is important to highlight that you must have good planning before taking out your personal credit. This way, you guarantee that you will not create debts that you cannot pay and become the protagonist of your financial life.

Is the uConecte personal loan worth it?

Well, you must be wondering if the uConecte loan is worth it, right?

Therefore, let's remember some main points so that you can make the right decision for your financial life.

So, personal credit is done safely and quickly through the app. Furthermore, you have access to all information in a transparent way so that you know all your conditions.

Furthermore, if you need money quickly, it may be ideal for you. This is because approval takes place within a few hours.

Furthermore, the payment period has a grace period of up to 45 days. This way, you can plan to pay off the debt without any problems.

Finally, anyone who can prove income can make their request. So, it's a good opportunity for those who need that extra money, right?

How to get a uConecte personal loan?

So, to apply for your loan, you must register on the application. The process is quick and can be done in a few minutes, using your Google account or another email address of your choice.

After that, simulate the loan easily and quickly and find out about all the conditions available to you.

Finally, you must analyze the proposals and choose the one that best fits your needs. Simple, don't you think?

So, if you want to know more about how to take out your personal loan, continue reading with our recommended content and don't miss this opportunity!

How to apply for the uConecte loan

The uConecte loan is perfect for those who need money quickly, with approval in a few hours. Find out how to order yours!

Trending Topics

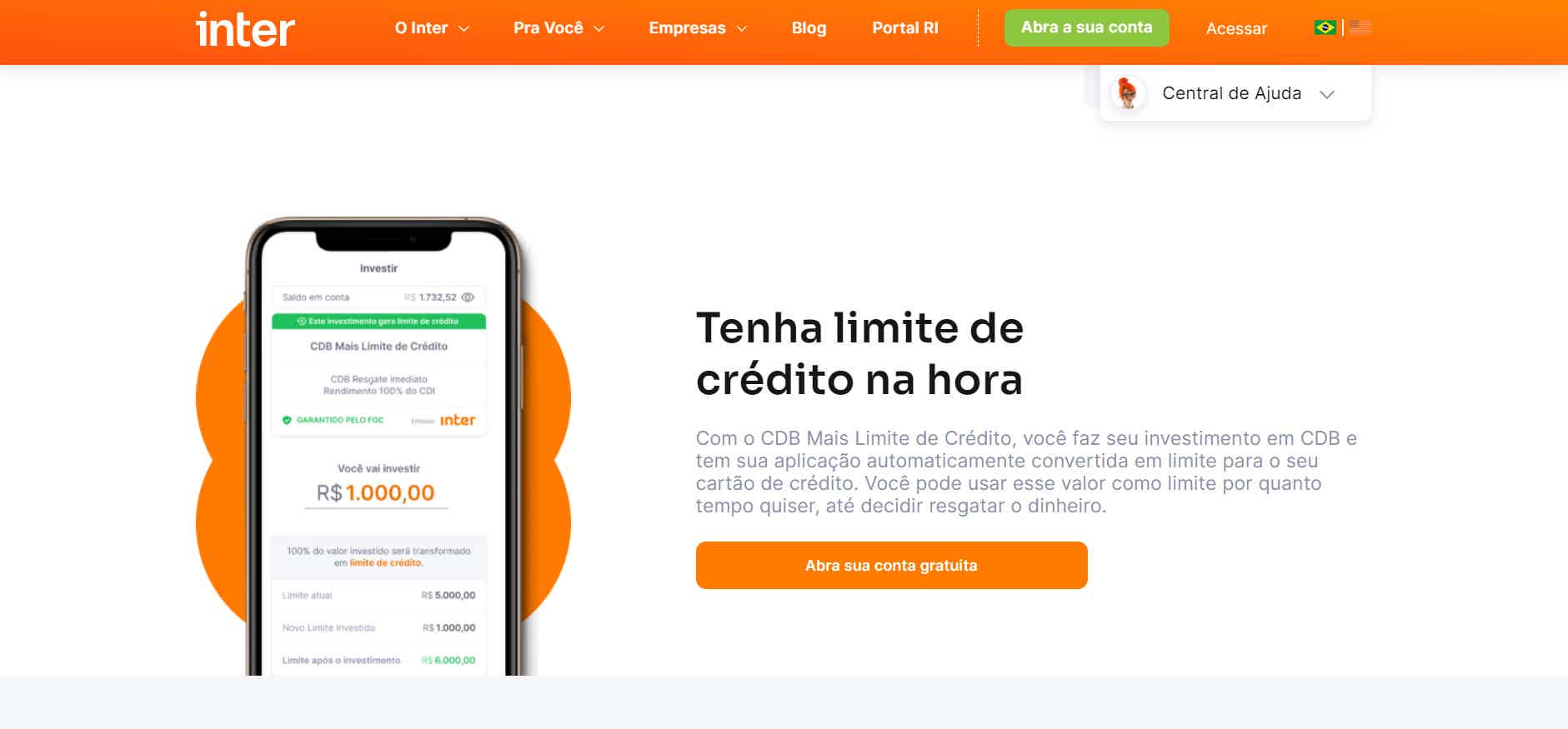

How to apply for an Inter Limite Invested card

See how to apply for the Inter Limite Invested card in the comfort of your home, with all the security, practicality and ease you need.

Keep Reading

Nubank payment assistant: what is it and how does it work?

Learn more about the Nubank payment assistant and see how it allows you not to default on your monthly bills!

Keep Reading

How to apply for the BRBCard Prepaid Card

BRBCard Pre-Paid Card can be an excellent choice for anyone who wants to control spending or is negative. Click and check how to apply!

Keep ReadingYou may also like

How to Apply for an Amazon Visa Card

Want discounts and rewards when shopping? The Amazon Visa card can offer you that. It is like? Just order yours and start enjoying. To find out how to apply, just read this post.

Keep Reading

The 7 best cashback cards

How about acquiring a credit card and still getting part of the shopping money back? That would be very interesting, wouldn't it? So, get to know the 7 best cashback cards that we have separated for you.

Keep Reading

Nubank payment assistant: what is it and how to use it?

If you want to simplify your payment routine, and also automate some accounts, the Nubank payment assistant will be a very useful novelty for you. Check out more about this functionality throughout the article!

Keep Reading