Cards

PagSeguro credit card: what is PagSeguro?

PagSeguro is a company specialized in delivering different types of ATMs in Brazil. Now, it is also possible to request a credit card from PagSeguro, which, in addition to being free of annual fees, offers several benefits to users.

Advertisement

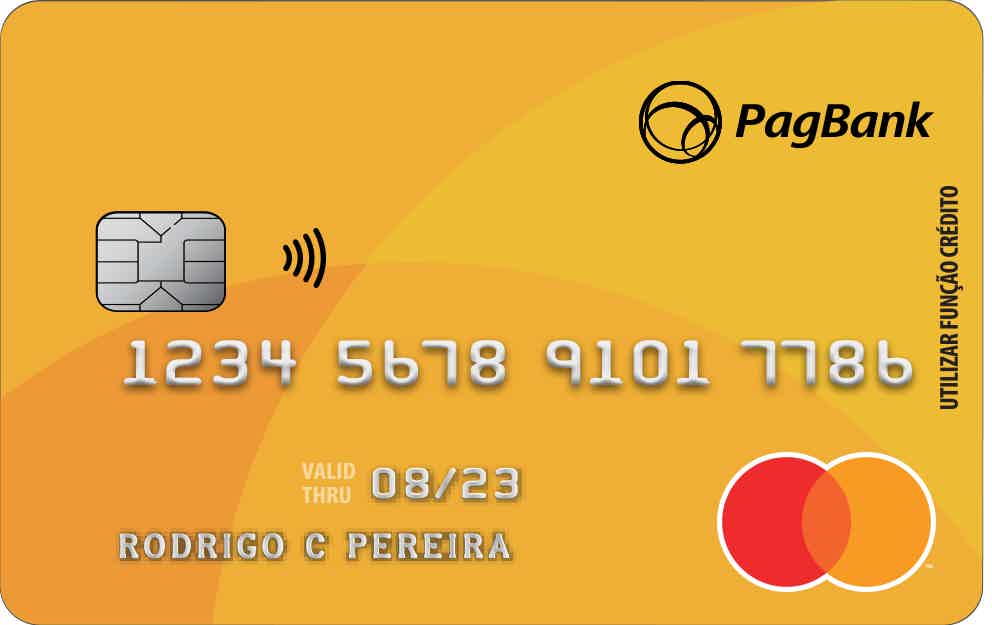

PagSeguro credit card

Since most consumers are currently looking for ways to replace cash with other payment methods, the PagSeguro card is the solution.

However, this change has a reason: cards deliver greater security and practicality in transactions.

Besides, walking around with cash in your hand nowadays is dangerous. Precisely for this reason, more and more card options are being created, all serving a certain customer audience.

Likewise, the PagSeguro card was created to make financial life easier for its customers. In addition, it delivers more practicality and safety, it also has excellent benefits!

How to apply for a PagSeguro credit card

The PagSeguro Card has no annual fee, it has the Mastercard flag, in addition to being international! And it still has exclusive advantages. Click here to see how to apply

| Annuity | Free |

| Minimum Income | not required |

| Flag | MasterCard |

| Roof | International |

| Benefits | No need to have a bank account free of annuity With international coverage No credit analysis |

Advantages PagSeguro

Like any payment method on the market, PagSeguro has the following advantages:

- No annuity;

- Less bureaucracy;

- In addition, it has greater security;

- Finally, it is accepted in several establishments.

Main features of PagSeguro

First, it is necessary to mention that the card has no annual fee and international coverage.

That is, the customer can shop at national and international establishments. And, even if the money leaves your account instantly, it is possible to buy in cash credit mode!

Therefore, as it is a prepaid card, the following benefits are guaranteed:

- Users can shop on all Visa-accepting sites;

- Possible to buy on major streaming services. However, it still has other unique benefits;

- In addition, cash withdrawals on the main Banco24Horas networks.

Who the card is for

Above all, the customer must consider whether the features of the card meet their needs. However, it is recommended for customers looking for more practicality and security in their daily transactions.

Finally, it has numerous advantages, targeting a diversifying audience, who are looking for practicality in their day-to-day.

Know the insurance card

The PagSeguro card has exclusive benefits for its subscribers, in addition to having a free annual fee! Click here to learn more about the card!

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Atacadão Card Denied: why?

If you have your Atacadão card application denied, don't worry. Check out our content that we help you increase your score!

Keep Reading

Beware of payroll loan scam

Getting the loan is an excellent option for those who need money. But, there are many scams in time. So know how not to fall

Keep Reading

Credit card EVERYONE'S card: what is EVERYONE's card?

The Todos Card offers several discounts on health, leisure and education services. Check out all its benefits here!

Keep ReadingYou may also like

Discover the Open Bank Prepaid Card

Discover the Open Bank card with international coverage, without annuity or maintenance fees. Read the text below.

Keep Reading

How to apply for the WiZink Benfica card

Do you want a complete credit card with more benefits while supporting Benfica? Then see how to request the WiZink Benfica card and take the opportunity to use the exclusive voucher and purchase a new jersey. See below for how to join.

Keep Reading

Home Broker Nu Invest: how it works

Nu Invest's Home Broker is the online space, inside the brokerage, that allows you to invest in variable income assets. See here its advantages and how to buy and sell shares through the tool.

Keep Reading