Cards

Passaí Card or Ponto Frio Card: which one is better?

If you are in doubt about which card to choose, the Passaí card or the Ponto Frio card, see here and clear your doubts.

Advertisement

Choosing between Passaí Card or Ponto Frio Card can be a difficult task, mainly because both have advantages and disadvantages. But comparing the modalities can help to request the ideal one for you!

Passaí X Ponto Frio: find out which one to choose?

First, the ideal credit card is one that meets your needs.

Above all, even though the benefits of the Passaí Card are similar to the Mastercard 2.0 models, there is an annual fee and it is necessary to fill in a minimum income to apply for it.

Above all, the Passaí Card is recommended for frequent customers of the store network. However, as it is a card that offers a positive return, users benefit greatly from its use.

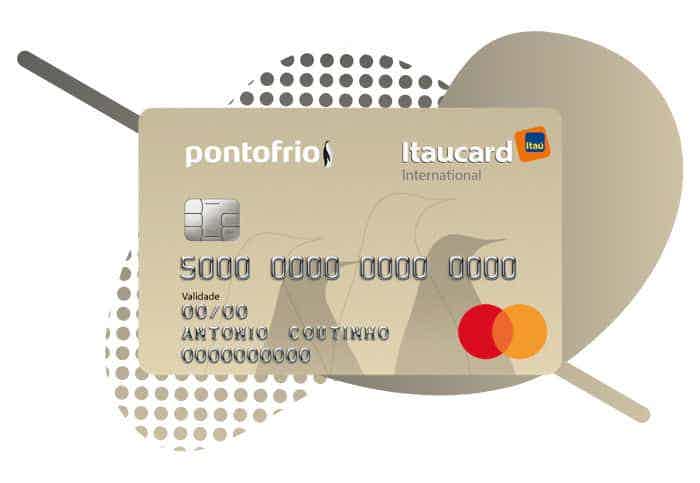

Issued under the Mastercard brand, the Ponto Frio Card is accepted in several national and international establishments. However, frequent customers of this network benefit more from this type of credit.

In this sense, Ponto Frio Card users have more possibilities to make purchases, outside or inside the company's networks.

How to apply for a Passai card

The Passaí card is a great option among store cards. After all, it offers advantages inside and outside Assaí establishments. See how to order yours!

How to apply for a Ponto Frio card

The Ponto Frio card is an option for those who usually shop at the store and want to save money. Also, for shopping anywhere, including abroad.

| I passed | Cold spot | |

| Annuity | 12x of R$ 12.90 | 12x of R $11.90 |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | When buying a unit, you pay the wholesale price; Access to Itaucard benefits; Purchases at national and international establishments. | Differentiated payment in installments at Ponto Frio units; Buy one get two; Pay half entry; Accepted in several national and international establishments. |

Passaí card

Above all, the Passaí Card is indicated to customers of the company's units who seek more opportunities in their purchases. If you like to save on your monthly purchases, this is a great credit option.

As you make purchases at company units with the Passaí Card, you have access to several exclusive discounts. In fact, one of the biggest benefits is that when you buy a unit, you pay the wholesale price!

Therefore, to access this benefit, it is necessary to pay the annual fee of R $12.90 monthly.

Likewise, Passaí card customers have several benefits on account of the Mastercard brand, which is issued.

Ponto Frio Card

However, the Ponto Frio card is indicated for the company's customers who seek more benefits in their purchases.

However, in partnership with Banco Itaú, a credit card is issued under the Mastercard brand. In this sense, when using the Ponto Frio card, customers participate in the Mastercard Surpreenda program.

In addition, it is accepted in several national and international establishments.

What are the advantages of the Passaí card?

Above all, when issuing your Passaí card, you have access to the following benefits:

- Pay for your products at the wholesale price;

- Up to 50% discount on entertainment services such as cinemas or theaters;

- Access to the Mastercard Surprise program;

- Up to 40 days to pay the invoice.

What are the advantages of the Ponto Frio card?

In addition, after issuing your Ponto Frio card, you have access to the following advantages:

- Differentiated installment plans for Ponto Frio chain products;

- Buy one product and get two;

- Pay half price for entertainment services, such as cinema or theater;

- Accepted in several national and international establishments.

What are the disadvantages of the Passaí card?

Finally, as well as other types of credit on the market, the Passaí card has disadvantages, they are:

- Annuity payment;

- Proof of income required;

- Lack of a benefits program of the establishment itself.

What are the disadvantages of the Ponto Frio card?

However, just as the Passaí card has disadvantages, the Ponto Frio card also has some, namely:

- However, annuity payment;

- It does not have its own card application;

- Minimum income required.

Passaí Card or Ponto Frio Card: which one to choose?

Finally, now that you know the main advantages and disadvantages of the Passaí and Ponto Frio cards, it is easier to compare the options and choose the ideal one for you!

Above all, consider applying for the credit card of the company you are a customer. Because, through them, users have access to exclusive benefits and discounts.

Anyway, even if the credit modalities are simple, it is still possible to count on exclusive payment opportunities with this card.

Therefore, requesting the Passaí Card or Ponto Frio Card is advantageous, especially if you are a customer of the chains. But, if you still have doubts, check out another very interesting card comparison below!

Santander SX Card or C6 Bank Card

Are you in doubt between Santander SX Card or C6 Bank Card? Both are international credit cards with different benefits. Check out!

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Find out how to take a free online IQ test

Find out your intellectual level with the free IQ test. Download right now and test your brain at no cost!

Keep Reading

How to apply for a loan with a property guarantee Creditas

Check out the complete step-by-step for you to apply for a loan with Creditas property guarantee and access better credit conditions!

Keep Reading

Méliuz Card or Mooba Card: which one to choose?

Be it the Méliuz card or the Mooba card, both are innovative cards, issued by Banco Pan, and which have cashback programs. Check out!

Keep ReadingYou may also like

How to open a BBVA Base current account

The BBVA Base current account has everything you need to manage your finances. It offers a debit card with no annual fee, free intrabank transfers and 3 free withdrawals. To know how to open it, just continue reading.

Keep Reading

Discover the Visa Vale Flex Car Card

A great benefit card option for employees, with discounts on automotive services, such as refueling and oil changes, in addition to having zero annuity and national coverage. Learn more below!

Keep Reading

How to apply for the NB Verde Dual card

Are you from Portugal and want a new credit card with an airline miles program and no annual fee? So request the NB Verde Dual and enjoy.

Keep Reading