Cards

Renner Card or CEA Card: which is better?

Between Renner card or CEA card, do you know which is the best option? Check out the advantages and disadvantages of each one and choose yours!

Advertisement

Renner or CEA, discover the best card option for you

Are you in doubt between the card Renner or CEA card? Both stores have a credit card that offers their customers more convenience and security when shopping! But don't know which one to choose? To help, check out some characteristics of the two cards below, so you can choose the one that best suits your goals. Let's go?

| Renner | CEA | |

| Minimum Income | is not required | Minimum wage |

| Annuity | 12X of R$11.90 (exempt in months when purchases were made only at Renner stores) | 12x of R$ 18.49 (exempt in months when purchases were made only at CEA stores) |

| Roof | International | International |

| Flag | Mastercard or Visa | Visa |

| Benefits | Mastercard Surprise, Visa Voucher, Discount Club, Table of Benefits, etc. | Discount on first purchaseInsurance and assistance against theftDirect withdrawal at C&A stores and the 24-hour Bank network |

How to apply for the Renner credit card

Learn how to apply for the Renner card step by step and without complications, the process can be 100% online.

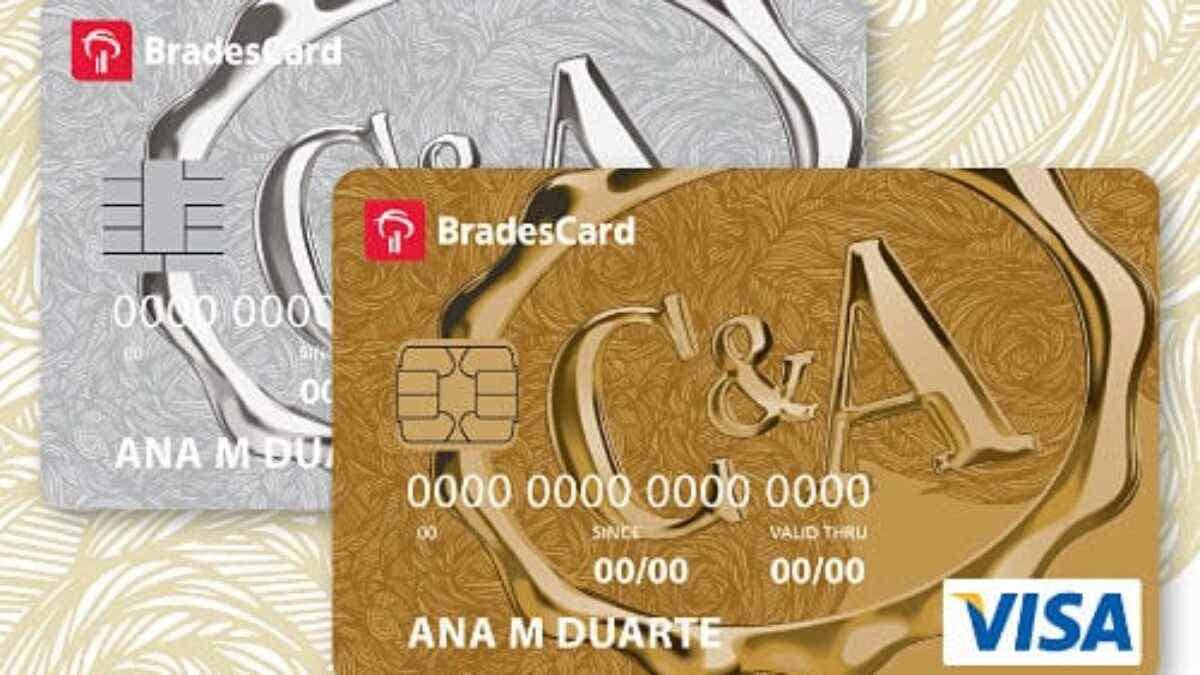

How to apply for the CEA Bradescard card

The CEA Bradescard card allows customers to make purchases with exclusive benefits at any store in the chain.

Discover the Renner card

The Renner credit card has two brands: Visa and Mastercard with international coverage, which give you access to almost all stores and establishments in Brazil and the world. In addition, it has an advantage club that offers a 50% discount at Renner partner stores and several other discounts.

What are the advantages?

- No proof of minimum income required;

- In the Lojas Renner app, you can generate payment slips, check the available limit, check your payment history or access your digital card;

- Protection Insurance;

- Access to the Mastercard Surpreenda or Vai de Visa program, depending on the chosen card;

- Multiple purchase installment options.

What are the downsides?

The main disadvantage of the Renner card is that there is no need to prove a minimum income, which can make it difficult to approve the card.

Discover the CEA card

The CEA card has a Visa flag with international coverage, so the customer has access to the Vai de Visa!

What are the advantages?

- Up to 40 days to pay;

- At CEA stores, purchases can be paid in up to 5 installments without interest or 8 installments with fixed interest and up to 100 days to start paying;

- When paying bills with the CEA card in up to 3 interest-free installments, you can still participate in the Abuse of Rewards program.

- Additional cards;

- Cash withdrawal at CEA stores, Rede Banco 24 Horas or call center in up to 15 fixed installments.

What are the downsides?

The main disadvantage is that to apply for the card it is necessary to go to a physical store in the network in person.

Renner card or CEA card: which one to choose?

The Renner or CEA card are safe and interesting card options with exclusive discounts and offers! So, compare the two options and see which one best suits what you want. But if you are still in doubt, check out two other card options: Americanas card or Magalu card.

Americanas Card or Magalu Card?

Learn a little more about the Lojas Americanas and Magazine Luiza cards, ideal for making purchases in a safe and practical way! Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to send resume to Bradesco? Check it out here

See in this post how to send a resume to Bradesco and take the opportunity to check out the main requirements that are found in vacancies!

Keep Reading

Online Caixa Mulher card: no annual fee and Elo Flex benefits

See in this post how the Caixa Mulher online card works and discover the unmissable advantages it offers the female audience!

Keep Reading

Get to know the Honda consortium

The Honda consortium brings several advantages to future recipients and provides an economical and planned shopping experience.

Keep ReadingYou may also like

6 signs that your financial planning is wrong

Do you do monthly financial planning but it seems like nothing is right? So here are some mistakes you might be making.

Keep Reading

8 best cards for Black Friday

Take advantage of Black Friday to earn up to 8% cashback! Get to know the best cards to take advantage of this date and buy your most desired items!

Keep Reading

See influencers who know how to make money with TikTok

Social networking applications are not just for entertainment and fun, and there are already those who know how to make good money with them. Through contracts with other giant companies, digital marketing secures millions of dollars in their accounts every year.

Keep Reading