Cards

How to apply for a Ponto Frio card

The Ponto Frio card is an option for those who usually shop at the store and want to save money. Also, for shopping anywhere, including abroad.

Advertisement

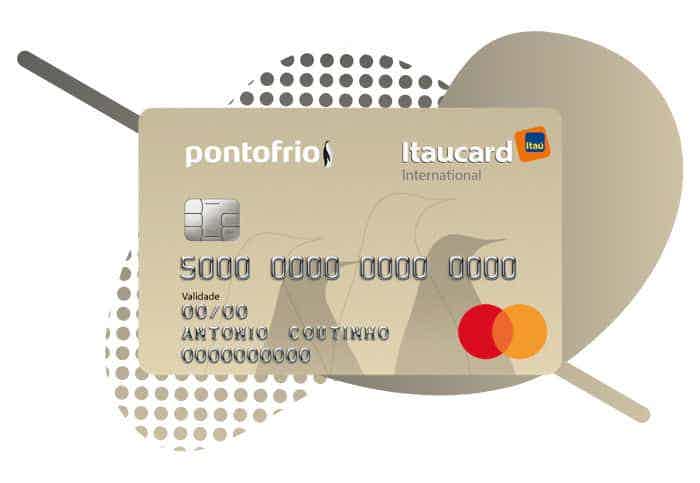

Ponto Frio Card

The Ponto Frio card is one of the most complete store cards we have in Brazil. After all, it has international coverage and the Mastercard brand.

With it, it is possible to make purchases in any establishment, in Brazil or in the world, that accepts the Mastercard flag. This, of course, not to mention the benefits of shopping at Ponto Frio stores.

So, be sure to check out how to request it in a few steps!

Step by step to apply for the Ponto Frio Card

If you are interested in applying for the card, see here for ways to get your card today.

Order online

To apply for a credit card without leaving home, just access the Itaú bank website. After all, he is the one who manages this credit product. See the step by step:

- Enter the institution's page;

- Right after that, click on the “cards” option;

- Then look for the card option and click on it;

- When opening a new page, click on “Order now”;

- Then, wait for the page redirection and fill in the form with personal data;

- Accept the terms and submit the proposal. You will receive a response to your email within a few days. After approval, the card has a delivery period of 15 days to your residence.

Request via phone

It is not possible to apply for the card over the phone. However, you can use the telephone service to clarify doubts and ask for clarification. See the numbers:

- For capitals and metropolitan regions: 3003-3030;

- For other regions: 0800 720 3030.

download app

Finally, it is also not possible to order a Ponto Frio card through the application. However, after receiving it, you can track expenses, limits and invoices through the Itaucard app. Still, you can make requests through this app.

Submarino card or Ponto Frio card: which one to choose?

Still in doubt if the Ponto Frio card is good for you? Well then, see it in comparison with another famous store card, Submarino:

| Submarine Card | Cold spot | |

| Minimum Income | A minimum wage (R$ 1,100) | R$ 800 |

| Annuity | 12 x R$ 15.70 (R$ 188.40) | 12 x R$ 11.90 (R$ 142.80) |

| Flag | MasterCard | MasterCard |

| Roof | National | International |

| Benefits | Mastercard Surpreenda, exclusive discounts at Submarino and an extra limit for purchases at the brand. | Mastercard Surprise, 50% discount in theaters and cinemas, 15% discount in Ponto Frio stores and special installment plan. |

How to apply for the submarine card

Discover now how to apply for the Submarino card step by step, simply and online 100%.

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Méliuz loan

Want to know how to apply for a Méliuz loan? In today's article we will show you the step by step. Click here and check it out!

Keep Reading

Neon account: how it works

Learn about the exclusive advantages of the Neon account, such as free monthly fees, free transfers and the possibility of waiving withdrawal fees. Check out!

Keep Reading

How to increase the score with Serasa Score Turbo

Learn how to quickly increase your credit score with Serasa Score Turbo and take care of your financial health again. See here how!

Keep ReadingYou may also like

Check out details about the new Porto Seguro digital account

With the aim of providing more resources in one place, Porto Seguro should launch its own digital account later this year. With exclusive advantages for Porto Seguro Bank users, the company promises interesting features! Know more.

Keep Reading

Mastercard Standard Card or Visa Gold Card: Which is Better?

Do you want to choose an ideal credit card for your day to day life and travel? Then Mastercard Standard card or Visa Gold card might be the best solutions for you. To learn more about them and their main differences, just continue reading with us and check it out!

Keep Reading

How to open a Bankinter Mini current account

The Bankinter Mini current account is a complete solution for anyone looking for financial education for their children, ages 0 to 17. If you want to know how to open one, check out the article below.

Keep Reading