Cards

Discover the Digio credit card

The Digio credit card is one of the many digital banking options in Brazil. It, like many of its competitors, waives an annuity and brings other benefits.

Advertisement

digital credit card

The Digio credit card may be an option for you who are looking for credit tools. He is Brazilian, belongs to a digital bank and brings advantages.

The card belongs to the digital bank of the same name. He, in turn, belongs to Bradesco, BB and Elopar. Thus, you are facing a card that offers convenience without sacrificing security.

Still, it is possible to apply for this card without leaving home. In a few steps, via the internet, you can apply. That way, you don't waste time with queues or long phone calls.

Interested? So be sure to continue your reading. Below are the main questions about Digio and the respective answers. So, see how you can get a credit option without leaving home.

How to apply for the Digio credit card

Digio is a digital bank that operates in Brazil and has a credit card for its customers, with exclusive advantages!

How does the Digio credit card work?

This credit card has a Visa flag and is international. In this way, it allows purchases in more than 40 million establishments worldwide. Incidentally, this in person and over the internet.

Despite this, the Digio credit card is limited to the credit function. That is, there is no debit function at first. That's why, in fact, you don't even have to be a Digio or Bradesco customer to get it.

What is the Digio credit card limit?

The Digio card limit varies according to the profile of each customer. After all, the digital bank takes into account some personal issues to grant the amounts. For example, the score on entries such as the Positive Consumer. Also, know that there is consultation with the SPC and Serasa.

In this way, there is no fixed limit, as well as there is no certainty of approval for the card. For that, it is necessary to have a clean name and good reputation in the square.

Is the Digio credit card worth it?

Check out the main pros and cons of the Digio credit card. With that, you can fully analyze whether it is worth it for you or not. After all, do not forget that the usefulness of an option varies according to each customer.

No annuity

Firstly, the Digio card does not charge an annual fee. In this way, it waives maintenance fees for card services. Still, it does not require any kind of compliance in return to keep the annuity away.

Waivers revolving interest

Another important point is that the Digio card does not charge revolving interest. That is, it does not charge one of the fees that most banking institutions impose in case of non-payment of the invoice in full.

In this case, then, it is up to the customer to choose a form of payment that fits in their pocket. So, the interest he will have to pay is below the market average, as they do not require one form of fees.

Digi Store

Also, those who are customers of the Digio card have the DigioStore. This is the store that belongs to the bank. Here you can buy a series of products and services under special conditions and prices. For example, prepaid Uber credits.

Go Visa Program

Another interesting point is that the Digio credit card offers the Vai de Visa Program. It is inherent in the flag. With this, it becomes possible to accumulate points according to the expenses in your invoice. Then exchange them for products, discounts and services.

Inability to pay the minimum invoice

On the other hand, not everything is rosy. If you do not have enough money to cover the invoice amount, you do not have the right to pay “the minimum”. That is, either pay all of it, or choose to pay in installments.

Exclusive use of debit

Another issue that can be a problem, depending on the customer, is that the credit card does not offer a debit function. Therefore, it is possible to use it only for credit payment purposes, either in cash or in installments.

How to make a Digio credit card?

To apply for the Digio card, simply enter the website or application of the digital bank. Then click on “Ask for your card” and follow the on-screen instructions. On the other hand, it is also possible to contact the digital bank by telephone, using the following numbers:

- 3004-9920 (capitals and metropolitan areas)

- 0800-721-9920 (other locations)

How to apply for the Digio credit card

Digio is a digital bank that operates in Brazil and has a credit card for its customers, with exclusive advantages!

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

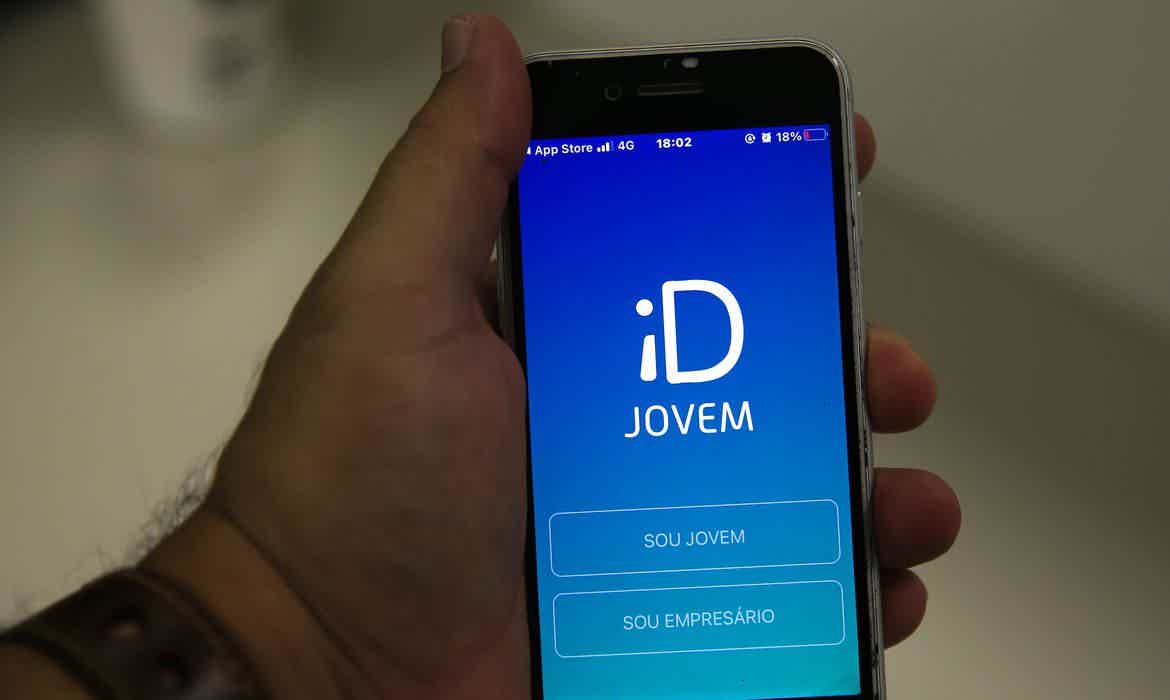

Meet ID Jovem

Find out how ID Jovem works, a Federal Government program for low-income youth between the ages of 15 and 29 registered at CadÚnico. Look!

Keep Reading

Renner vacancies: how to check the options?

See the main Renner vacancies currently open and check out the benefits that this great company can offer for you to grow!

Keep Reading

How does the bank approve the customer?

Knowing how the bank approves the customer is essential to use the information in your favor and increase the chances of credit approval. Look!

Keep ReadingYou may also like

Discover the EuroBic Futuro current account

The EuroBic Futuro account is ideal for young people aged 12 to 17 to take care of their financial life, as it has no maintenance or opening fee. To learn more about this complete option, just keep reading with us!

Keep Reading

How to apply for PayPal card

See here how to have your PayPal card online through the website or the application without having to leave your home.

Keep Reading

Discover the Citi Prestige Card

Prestige is part of the name of this card. The Citi Prestige Card, from Citibank, has many advantages, exclusivity and benefits. Want to meet him? Follow our content with all the information.

Keep Reading