loans

Get to know the online loan Free Loan Bank

Get to know the online loan Banco Loan Livre and see if this loan is what you need right now! Check out!

Advertisement

Online loan Free Loan Bank

So, the online loan Banco Loan Livre is a type of credit that works on an online platform with the security and speed needed to apply for a loan! In this, he seeks to offer the best offers and options for customers, being ideal for negatives!

So read on to find out what this loan has to offer! Check out!

How to apply for a Free Loan Bank loan

Do you want to learn how to apply for a free bank loan with exclusive terms and conditions? Then continue reading to learn the step by step!

| Value | From R$ 100.00 to R$ 6,000.00 |

| Installment | Up to 12 months |

| Interest rate | not informed |

| accept negative | Yes |

| release period | Up to 2 business days |

How does the Free Loan Bank online loan work?

Well, the online loan Banco Loan Livre is an ideal credit modality for people with negative credit scores or low credit scores. That's because, he doesn't consult credit agencies like SPC and SERASA, and still allows you to apply quickly and safely!

Furthermore, in order to access the loan, you must have a limit on your credit card, because it will act as your payment guarantee, as the loan installments will be automatically debited every month.

On the other hand, in the case of bank slips, you must present the slips that will be paid and their total sum cannot exceed R$6 thousand reais, and can be paid in up to 12 months on the card. If it is a transfer, you can use an amount between R$ 100.00 and R$ 6 thousand and then you need to pay the installments in 12 installments on your credit card.

That is, the loan amounts will depend on the amount available in the credit card limit. Therefore, it is a great option for those who need secure and fast credit!

What is the limit of the online loan Banco Loan Livre?

So, the loan limit will be the amount available on your credit card limit. On the other hand, in the case of bank slips, as mentioned earlier, you must present the slips that will be paid and the total amount cannot exceed R$6 thousand reais.

Is online loan Free Loan Bank worth it?

So let's know the advantages and disadvantages of this loan! Check out!

Benefits

So, the loan is ideal for negatives and people with a low score, as they do not do an analysis with credit agencies such as SPC and SERASA.

In addition, it has a fast and secure online application process, without having to go to a financial agency.

Another advantage is that the payment of the loan is made within 2 business days, as well as the amount of the loan will be the limit of your card, or even up to R$6 thousand reais, in the case of bank slips, being able to pay in installments up to 12 times.

Also, the loan discount is made directly on the credit card bill, as well as having reduced interest rates. Therefore, it is a very interesting type of credit and unlike anything you have ever seen on the market!

Disadvantages

Among the disadvantages of this loan, the first one that we can highlight is the amount of credit that will depend on the customer's credit card limit.

That is, if your limit is low, your loan will also be low.

In addition, depending on the amount of the loan, the 12-month period may be too short to pay it off in full. So, before opting for this loan, take it easy to make sure it's a good option for you!

How To Get An Online Bank Loan Free Loan?

So, to make the loan is very simple! That's because, just access the Livre Digital website and do the simulation. The fact is that there is a process for each type of need, whether for bank slips or financial transfers, so enter and click on the recommended content below to learn!

How to apply for a Free Loan Bank loan

Do you want to learn how to apply for a free bank loan with exclusive terms and conditions? Then continue reading to learn the step by step!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

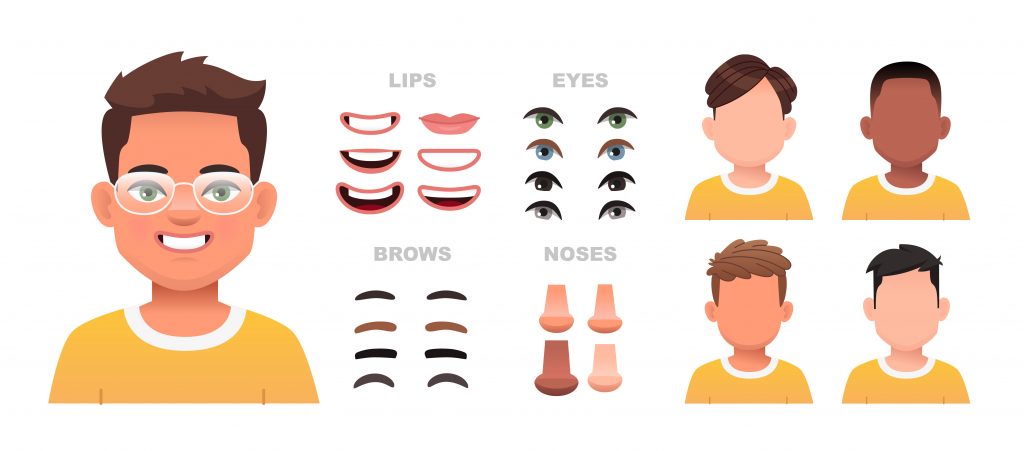

Avatar Maker Apps: Create fun cartoons

Explore avatar maker apps and personalize your online identity in a fun and unique way. Know more!

Keep Reading

Itaucard Click card or Itaú Personnalité card: which one to choose?

Itaucard Click card or Itaú Personnalité card: find out all about these Banco Itaú cards, with international coverage and discounts.

Keep Reading

Control your health precisely: Discover and download apps to measure glucose

Keep your diabetes under control and take care of your health the smart way. Discover here the best apps to measure diabetes.

Keep ReadingYou may also like

Credit card machine scam increases again in Alagoas

Since the beginning of the coronavirus pandemic, fraudsters have taken advantage of the increase in delivery orders to apply scams. The one with the cardboard dobby with the damaged display is the most recent, and it may also be the most damaging of them all. Know more!

Keep Reading

Even if you have lost your Auxílio Brasil card, you can withdraw the benefit!

Even with the loss of the Auxílio Brasil benefit card, it is still possible to use the value of the benefit. In fact, you only need to have the CaixaTEM application installed on your cell phone to make payments, transfers and even ATM withdrawals.

Keep Reading

How to enroll in ProUni

ProUni is a Ministry of Education program aimed at low-income students who wish to enter college. See how to register here.

Keep Reading