loans

Discover the Sicredi personal loan

Get to know the Sicredi personal loan and understand how this loan can help you solve your financial problems!

Advertisement

Sicredi personal loan

Initially, the Sicredi personal loan is a great loan option, aimed at members of the cooperative bank. So, get to know the Sicredi personal loan and other information about this way to get money!

In this regard, in this loan there is no need to prove the purpose of credit and the payment period is up to 48 months. So, continue reading to learn a little more about this Sicredi product!

How to apply for a Sicredi loan

Learn how to apply for the sicredi loan and other useful information about this loan, so that you can pay off all your debts!

How does the Sicredi personal loan work?

Well, the Sicredi personal loan is aimed at all members of the Sicredi bank, that is, it is not an affordable loan for anyone.

Furthermore, it is not necessary to prove the purpose of the credit, as well as the payment method can be in installments or in a single payment.

This is because it will vary according to the needs of the users and the credit is automatically debited from the current account.

Therefore, the Sicredi personal loan works to make life easier for Sicredi customers, with security and comfort when applying for loans!

What are the advantages of the Sicredi personal loan?

Initially, the first advantage is that there is no need to prove the purpose of the credit.

In addition, the payment method can be paid in installments or in a single payment, according to the customer's needs.

Likewise, the amounts will be automatically debited from the current account. That is, there is no stipulated deadline for the release of values.

This is because, with the amounts approved, the release is immediately after the credit analysis carried out by the Sicredi institution.

In this, the credit limit will also be released according to the payment terms and the payment deadline will be up to 48 hours!

Therefore, the Sicredi personal loan has several benefits that applicants can enjoy safely!

What are the disadvantages of the loan?

Well, the biggest disadvantage of this loan is that it is not accessible to everyone, but only to Sicredi bank account holders.

Is Sicredi personal loan worth it?

So, it is worth taking out the Sicredi personal loan, as it is a great solution for Sicredi bank members with exclusive conditions.

Furthermore, it is a process that brings convenience and security, as it can be done through Sicredi agencies.

Therefore, make an analysis of all the pros and cons of the personal loan, to find out if you fit the criteria and then apply!

How to take out a Sicredi loan?

So, to apply for a Sicredi personal loan, you must have your personal documents in hand and go to a branch in person to apply!

Therefore, when choosing to apply for the Sicredi personal loan, you must be an account holder at the bank and meet the cooperative's criteria! So, now that you know how everything works, let's show you how you can access it!

How to apply for a Sicredi loan

Learn how to apply for the sicredi loan and other useful information about this loan, so that you can pay off all your debts!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

2022 Bolsa Família Calendar

The 2022 Bolsa Família Calendar is now available for consultation. Keep reading and find out when you will receive and enjoy your benefits.

Keep Reading

PagSeguro Card or Afinz Card: which is better?

PagSeguro card or Afinz card, both have satisfactory advantages. But which one is the best option for us to order? Check out!

Keep Reading

Lanistar Invoice Card: how to consult

The Lanistar card invoice can be a mystery to many people, as it is several cards in one. In this article, we'll explain how it works.

Keep ReadingYou may also like

What is the Neo card used for?

The possibility of exemption from the annuity has been increasingly sought by customers. And, an excellent card that offers this advantage is Bradesco's Neo. Read this post and learn more about it.

Keep Reading

How to apply for Bradesco university credit

With Bradesco university credit, you can finance up to 100% of the college semester amount in up to 12 months. To find out how to order yours, read on!

Keep Reading

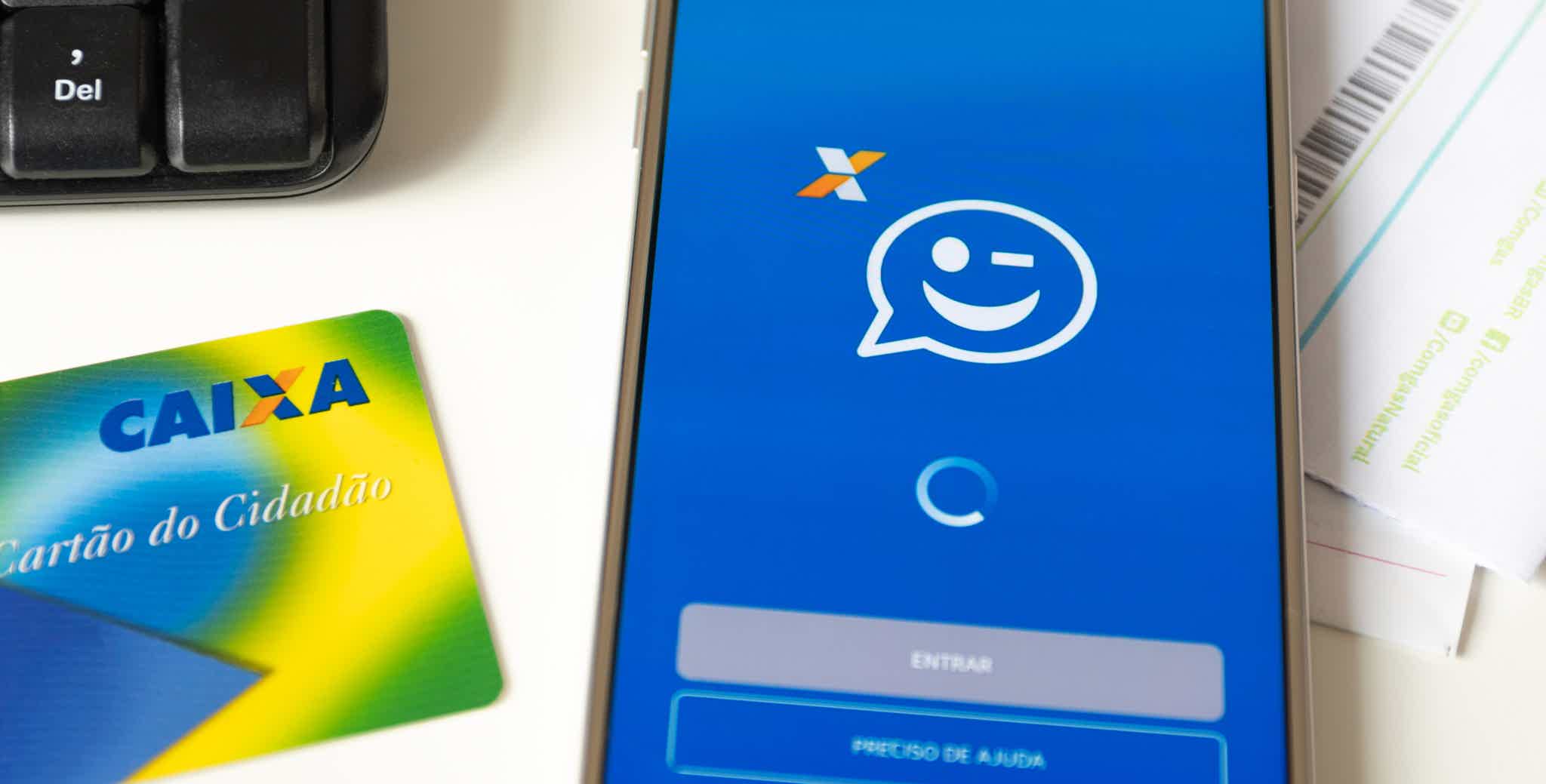

See how to update data in Caixa Tem to apply for the new Caixa microcredit

Individuals who wish to apply for the new Caixa microcredit must do so through the Caixa Tem application. However, you must update the resource before ordering. Below is a guide to the entire upgrade process.

Keep Reading