Cards

How to apply for the C&A Bradescard card

The C&A Bradescard card allows customers to make purchases with exclusive benefits at any store in the chain. In view of this, check below how to apply for this card and take advantage of the advantages it has to offer.

Advertisement

C&A Bradescard credit card

The C&A Bradescard card was developed especially for those who are already customers of the stores and want to get bigger discounts, as well as access to exclusive offers. Therefore, it undoubtedly becomes a great ally for saving money when making your purchases. As well as having a new way of managing payments and having credit in the market.

But, thanks to the C&A credit card, you can make purchases in thousands of stores and establishments that accept this form of payment. That's why we've written this article with some information on how to apply for a credit card. So, check out our article and get yours now.

Step by step guide to applying for a C&A Bradescard card

So, to apply for the C&A card, you must be over 18 years old, prove your income from the last 3 months, and not have a negative credit history with Serasa. Therefore, not everyone can apply for this card. However, if you meet these requirements, you will have to go to one of the C&A stores with your personal documents.

When you arrive at the store, go to the customer service center and request your credit card. Then, after submitting your application, it will undergo a credit analysis and if approved, you will receive your card and can use it to make purchases with special discounts.

Therefore, check out other ways to contact C&A about your credit card and how to request it.

Order online

Customers cannot yet apply for the C&A Bradescard card through the website. Therefore, you must go to one of the chain's physical stores, bringing your personal documents. After that, just speak to one of the attendants to make the request.

Request via phone

So, it is not yet possible to order the C&A card over the phone. However, you can request information about this product by contacting the Customer Service Center on the following telephone numbers:

- 4004-0127 (capitals);

- 0800-701-0127 (other regions);

- 0800-722-0099 (hearing impaired).

download app

However, the app cannot be used to apply for a Bradescard card. This is because its main purpose is to allow customers to obtain information about their bill, available credit, among others. However, it is available on Google Play and the App Store, which undoubtedly makes it easier for many customers to access.

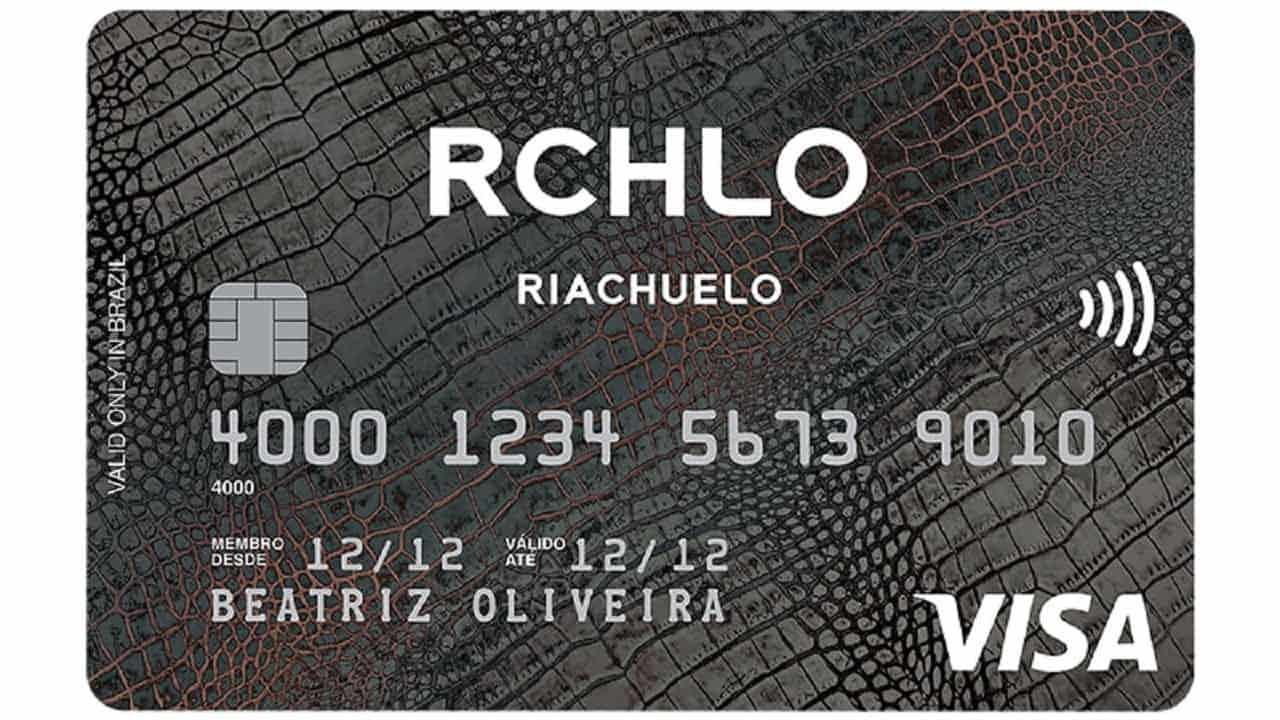

Riachuelo card or C&A Bradescard card?

So, to make their customers' daily lives easier, several retailers have created their own credit cards. After all, this product allows consumers to have special payment conditions, as well as discounts when making their purchases.

Therefore, due to these advantages, it can be difficult to choose between the Riachuelo card or the C&A card, for example. Therefore, we compared the main information about these two credit cards so that you can evaluate which is your best option. So, check out the information below.

| Riachuelo Card | C&A Bradescard Card | |

| Minimum Income | Minimum wage | Minimum wage |

| Annuity | R$ 87.00 | R$ 221.88 |

| Flag | MasterCard | Visa |

| Roof | National | International |

| Benefits | 24-hour emergency servicePoints system to exchange for productsSecurity and flexibility in paymentsAccepted in millions of locations worldwide | Discount on your first purchaseDifferentiated installmentsInsurance and assistance against theftDirect withdrawal at C&A stores and the Banco 24 horas network |

How to apply for the Riachuelo credit card

Check out our complete tutorial and apply for your Riachuelo credit card without bureaucracy.

About the author / Lays Brandão

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

BTG+ credit card: how it works

Enjoy exclusive benefits such as zero annuity for three months, CPF monitoring and investment opportunities. Find out how the BTG+ card works!

Keep Reading

Spotify Credit Card: What is Spotify?

Spotify prepaid credit card allows you to have premium access to the platform, in addition to other benefits. Learn more here!

Keep Reading

What is the best credit card score?

Do you need to have the best score to apply for a credit card? There is no exact score value, but an ideal value for each card. Understand!

Keep ReadingYou may also like

Make the dream of owning your own home come true: get to know Minha Casa, Minha Vida

Minha Casa, Minha Vida allows you to finance the property of your choice, in addition to having low interest rates and government security. Learn more in the article.

Keep Reading

How to open a current account at BPI Age Jovem

At BPI, anyone aged between 13 and 25 can create an account with a minimum opening fee and no maintenance fee. Check here how to open yours today.

Keep Reading