Cards

Discover Pride Bank Prepaid

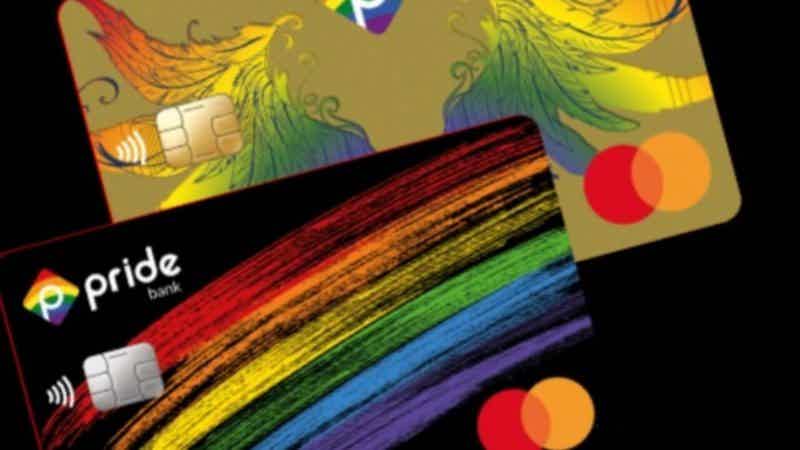

Meet the first digital bank aimed at the LGBT community that brings several advantages such as the inclusion of the social name on the card! Check out!

Advertisement

How does Pride Bank Prepaid work?

Initially, Pride Bank Pré-Pago is a card formed in partnership with Weligth, which develops tools that ensure the proper use of resources with security and transparency. Furthermore, this card works linked to a digital account and is considered the first LGBTI+ digital bank in the world!

Well, this one is modern, simple and not rechargeable. That's because, it works with whatever balance is available in your Prime Bank account. That is, it brings more convenience to your purchases in online stores, as well as in physical stores.

So, Prime Bank Pré-Pago is a great option for those looking for a life with more practicality, security and comfort, as well as the speed and transparency you need in all your financial transactions!

Therefore, see below a table with the characteristics of this card and learn a little more about this great news:

| Minimum Income | there is no mention |

| Annuity | EXEMPT |

| Flag | MASTERCARD |

| Roof | International |

| Benefits | digital account Annuity Exemption National and international coverage No need to reload super modern design Mastercard Surprise Program |

How to apply for Pride Bank Prepaid

See how you can apply for Pride Bank Prepaid, Pride Bank digital bank card, the world's first LGBT digital bank!

What are the advantages of the Pride Bank Prepaid Card?

So, let's get to know the advantages of Pride Bank:

- Initially, the first advantage is the absence of annuity, as well as the low maintenance fees of this card;

- Another advantage is the national and international coverage, that is, you can use it in physical and online stores all over the world;

- And besides, this card does not need to be recharged. This is because, it uses the balance of your own Pride Bank account (that is, you need to have a balance in the digital account);

- For card users, there is also the Mastercard Surprise program, a Mastercard program full of exclusive benefits for users;

- Another advantage is the super modern design of the card, which also has the possibility to put your name the way you want;

- Also, a percentage of all Pride Bank revenue goes to Instituto Prime's social causes, as well as to Culture, Entertainment and several other programs that aim to bring improvements to the entire LGBT community.

Therefore, this card also has several benefits, it also supports LGBTI+ causes, leaving its mark and inclusion in society, as well as being the first LGBT digital account in the world! It's too much isn't it?

What are the downsides?

Well, one of the disadvantages of Pride Bank Prepaid is the fees charged. This is because it charges a prepaid card maintenance fee of R$3 (monthly), as well as a card issue fee of R$19.90.

Is Pride Bank Prepaid worth it?

Well, one of the card's most interesting features is its modern, personality-filled design. However, what really stands out is the possibility of inserting your social name into it. This is because, in this way, it would avoid embarrassment for transvestites and transsexuals, for example.

Furthermore, another differential of Pride Bank is its support to social entities, converting around 5% of its total gross revenue to NGOs and other LGBT entities. Furthermore, the bank also invests in Culture, Entertainment and Sports for the LGBT community.

So, Pride Bank is an inclusive digital bank aimed at all consumers, not just the LGBT community, which has a card with no annual fee and does not carry out a credit analysis. That is, another option for people who are negative.

Another advantage is that in the application of your digital account, you can have access to all your financial transactions, being able to manage your expenses in a safe and practical way. Not to mention, on the super personalized card, the way you always wanted!

So, from what we've found, it's worth having Pride Bank prepaid, even if it has acquisition and maintenance fees.

How to make Pride Bank Prepaid?

So, first of all, you need to have a Pride Bank digital account, in order to apply for your Pride Bank Prepaid card and thus enjoy all the exclusive advantages that this card offers.

Therefore, to make the Pride Bank Prepaid card, we will show you the steps you need to follow.

How to apply for Pride Bank Prepaid

See how you can apply for Pride Bank Prepaid, Pride Bank digital bank card, the world's first LGBT digital bank!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to send resume to Cocoa Show? Check it out here

Find out how to send your resume to Cacau Show completely online and see what the main requirements are for job openings!

Keep Reading

Havan Card or Carrefour Card: which one to choose?

Find out about options that offer facilities for in-store purchases. Then, follow our comparison between the Havan card and the Carrefour card!

Keep Reading

Balaroti financing or Bradesco Reforma financing: which is better?

Get to know Balaroti financing or Bradesco Reforma financing and understand which is ideal for you to carry out your renovation. Learn more here!

Keep ReadingYou may also like

How to make the first investment in the C6 Bank Platform

Check out how to make your first investment on the C6 Bank Financial Platform available in your account application. Start investing with less than R$20 and pay no brokerage fee. See more below.

Keep Reading

Ranking of the best payroll credit cards 2022

For those who are retired, INSS pensioners or civil servants, payroll credit cards make life easier due to reduced rates and greater benefits. See, below, which are the best available in Brazil.

Keep Reading

How to calculate the overdraft interest rate

Is it worth paying the overdraft interest? And how to get out of it? There are several questions about this service that the bank offers, right? Therefore, today we are going to explain everything about the overdraft interest rate. Check out!

Keep Reading