Cards

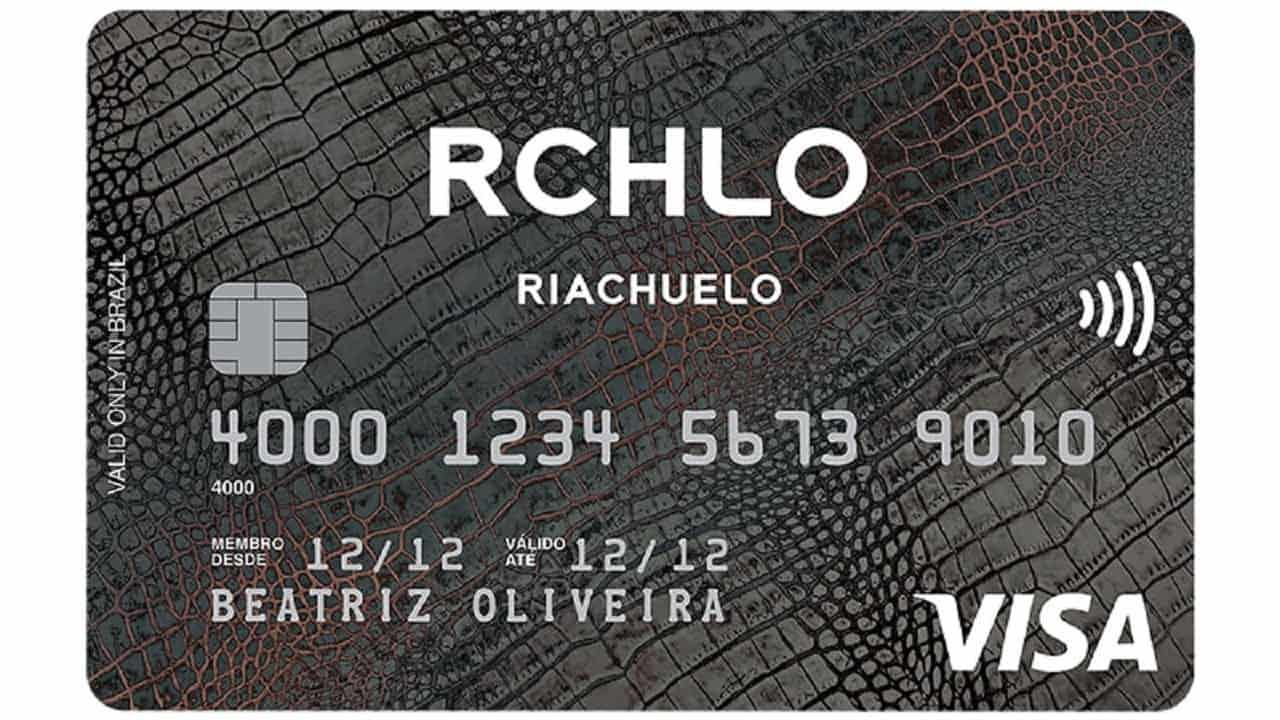

Discover the Riachuelo credit card

The Riachuelo credit card can be issued with the Visa or Mastercard brand and has nationwide coverage. It also offers discounts and special conditions at partner stores.

Advertisement

Riachuelo Card, with special conditions in partner networks

O Riachuelo card is a partnership with Financeira Midway that offers an exclusive card for use in stores and a credit card with Visa or Mastercard, which can be used in any establishment in Brazil that accepts the brand. In addition, with the card you have some exclusive benefits in partner stores. So, do you want to know more? Continue reading and check it out below!

| Private Label | MasterCard | Visa | |

| Annuity | Free | R$118.80 | R$118.80 |

| minimum income | Minimum wage | Minimum wage | Minimum wage |

| Roof | National | National | National |

| Benefits | Exclusive discounts and promotions at Riachuelo stores. | Mastercard Surprise | Go from Visa |

How to apply for your Riachuelo credit card

Discover in this article some features of the Riachuelo card and how to request it step by step in a simple way and 100% online.

How does the Riachuelo card work?

The Riachuelo card has three options:

- Private Label – exclusive for purchases at Riachuelo Stores;

- National visa;

- National Mastercard.

Cards can be managed through the Riachuelo app or the Midway app, which is the brand's digital account.

Benefits

With the Riachuelo Visa or Mastercard, you can access several programs and benefits, such as:

- 15% discount on purchases at Philips and Carrefour Foods stores;

- from 5 to 40% discount on products from the Extra store website.

In fact, you can also participate in programs such as Vai de Visa and Mastercard Surpreenda. In addition, you can pay for your purchase in 5 interest-free installments or in 8 interest-bearing installments and get a 10% discount on your first purchase at Riachuelo stores.

Disadvantages

The main disadvantage of the Visa or Master card is the annual fee of R$1,800,000 or 12x9,90. In addition, there is no miles, points or cashback program, which is an attractive feature of current cards.

How to apply for the Riachuelo card

To apply for the card, you must first request the exclusive use card in stores. This process can be done on the app, available for Android or iOS, or at a Riachuelo store, presenting a photo ID and CPF. After that, you can request the credit card on the app.

Alternative recommendation: Renner Card

If you're still not sure whether the Riachuelo card is the right choice, check out a comparison we made with the Renner card and see which one is best for you.

| creek | Renner | |

| Minimum Income | Minimum wage | is not required |

| Annuity | R$118.90 | 12X of R$11.90 (exempt in months when purchases were made only at Renner stores) |

| Flag | Visa or Mastercard | Mastercard or Visa |

| Roof | National | International |

| Benefits | Exclusive discounts from partners | Discount Club, Benefits Table |

Did you like the content? Then take advantage and learn how to apply for your Renner card right now!

How to apply for the Renner credit card

Learn how to apply for the Renner card step by step and without complications, the process can be 100% online.

About the author / Gustavo Cezar

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to find the best receptionist jobs

Learn everything you need to find the best receptionist jobs. And understand what your resume should look like.

Keep Reading

Is there a way to get the work card over the internet 2021?

Did you know that it is possible to get your work permit online? Check here how to access your document without leaving home!

Keep Reading

What does Bolsa Família Blocked mean?

Do you know what Blocked Family Scholarship means? Is it suspended or cancelled? Then continue reading, because we'll show you the difference!

Keep ReadingYou may also like

Conquer your financial independence by reselling Quem Disse Berenice

Becoming a Quem Disse Berenice reseller is much easier than you might think. With a few clicks and an uncomplicated form, you already guarantee your access and you can start selling. Learn more here.

Keep Reading

What is the Santander withdrawal limit?

The Central Bank does not require any withdrawal limit rule from digital and traditional banks, on the contrary, it only suggests values for the safety of the customer. So, check here how this limit works at Santander bank and see what to do if you need a higher amount.

Keep Reading

Discover the Daycoval loan

Are you in need of some extra cash? For this, we can count on several tools, and one of them is the payroll loan. So, get to know the Daycoval bank payroll loan option and stay on top of it!

Keep Reading