lists

7 digital accounts for negatives

Digital accounts for negatives have great functions and make life easier for those with CPF restrictions. Check out our list of 7 of them!

Advertisement

Find out how to open an account with a bad name

Most financial institutions already have good digital account options. It is natural that customers are increasingly connected and want to move their money easily, quickly and 100% online. But there are also excellent digital account options for negative people!

Therefore, with so many financial institutions and brokers in the Brazilian market, it can be difficult to choose the one that best fits your profile. Furthermore, those with restrictions on their CPF must know how to select the best option, as banks and fintechs increasingly seek to attract this audience.

Therefore, we will help you find out which institutions have the best digital accounts for negative people, and their main information. So, stay with us and check it out below.

What are digital accounts and how do they work?

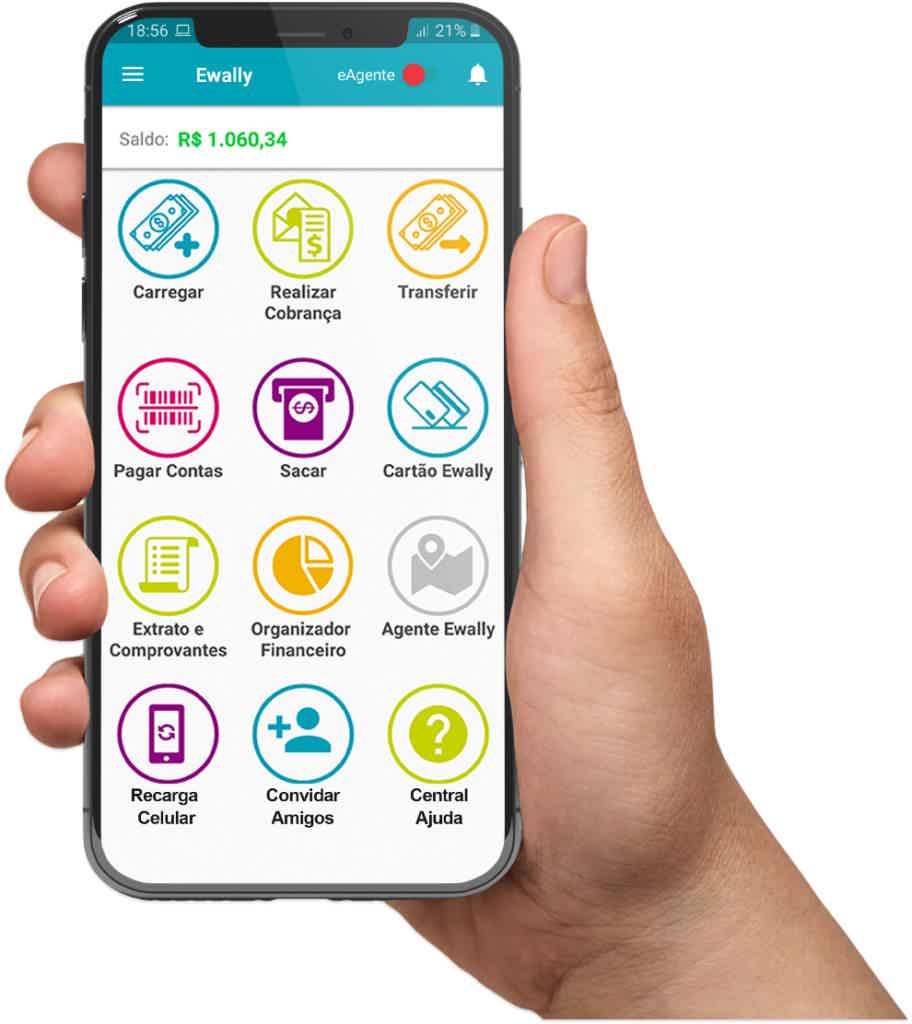

Because digital accounts are much more advantageous for negative people than common bank current accounts! In short, digital accounts can be opened through the bank's website or app, as well as offering a more comprehensive package of services. In addition, most are exempt from fees or maintenance or transfer fees.

Therefore, digital accounts are excellent alternatives for negative people! As they have lower fees and bureaucracy, making it possible to manage values in a practical way.

With the exception of withdrawals, as the bank normally uses Banco24Horas ATMs, the Cirrus network, the Plus network, among others. So, in this case, there is a fee charged per withdrawal.

Furthermore, these accounts generally offer the option of a prepaid credit card along with it, with no annual fee. In other words, more benefits for negative people to choose a digital account to call their own!

Digital account features

In fact, through your digital account you have access to:

- transfers,

- bill payment,

- deposits,

- investments,

- loans,

- credit cards,

- consortia, insurance,

- among other financial products and services.

So, all control and movement of this account can be done through the bank's app or website. So, you have access to:

- follow the bank statement,

- make transfers,

- pay the bills,

- recharge your cell phone,

- include the card in digital wallets,

- issue virtual card,

- between others.

Furthermore, there are some online accounts that allow your money to earn returns at higher rates than savings, for example. It is worth noting that all support generally takes place online and, in many cases, there is 24/7 support.

In short, digital accounts for negative people bring many advantages for those who need a practical financial service to manage their finances, and even get a credit card!

So, if you have restrictions on your CPF but would like to take advantage of all these advantages, don't worry! We're going to make the search process easier and present great options for digital accounts for negative people below!

Don't miss it below.

Is Digital Account worth it?

Those who have a digital account have all the practicality and agility, manage banking services and transfers through the app and more. Find out here!

What are the best digital accounts for negative people?

So, as we said, financial institutions are increasingly targeting the public looking for digital accounts for those with bad debts, or even those who just want a simpler account without many requirements.

Given this, fintechs identified this opportunity and invested in technologies to facilitate the financial transactions of their customers with restrictions on their CPF.

So, those who don't adapt are left behind. Therefore, most digital banks are also jumping on the bandwagon of digital accounts for negative people.

So, now check out 7 good digital account options for you to choose yours!

Superdigital

Superdigital is Santander's digital bank. There you have access to a digital account with no maintenance fee with Pix transfers and between free and unlimited Superdigital accounts. Transfers between banks and withdrawals from Banco24Horas ATMs are charged R$ 5.90 and R$ 6.40, respectively.

In addition, you have access to an international prepaid card (subject to credit analysis) with the Mastercard brand. It has no annual fee and has many benefits associated with the brand, such as the Mastercard Surpreenda Program.

It is worth noting that to open your account there is no consultation with the SPC and Serasa, nor is there a requirement for proof of income. To carry out this process, simply access the bank's website and fill out the registration form. After that, all account transactions can be done through the app.

How to apply for the Superdigital credit card

If you have doubts about how to apply for the Superdigital credit card, after this text you will definitely not have any more!

C6 Bank

.

C6 Bank is a financial technology company that emerged with the aim of bringing practicality and ease to your financial life. Therefore, it is a fully digital bank that invests in its target audience in search of agility and good interaction with the digital world.

And with this in mind, the company brought an interactive and practical digital account to its customers. This digital account can be requested at any time via the C6 Bank website or app, requiring few documents and a quick assessment.

Furthermore, the account does not charge fees or annual fees for the digital account. Just as it offers unlimited and free transfers and withdrawals at Banco24Horas ATMs. In addition, it has three cards: C6 debit, C6 credit and debit and C6 Black (subject to credit analysis).

All of them are international with the Mastercard brand and have many benefits, such as no annual fee, the Atom Points Program, the Mastercard Surpreenda Program, the C6 Tag (free tolls and parking without queues), among other advantages.

To open the account and request the card, simply download the bank's app and fill out the proposal. If you are approved, you will be able to start operating your account and enjoy all the benefits associated with it.

Thus, with your digital account, the user will be able to carry out all banking transactions from traditional current accounts. However, it is completely easy to manage and control your finances and expenses completely online through the application.

How to apply for the C6 Bank credit card

Find out now in this article how to apply step by step for your c6 bank card without complications.

Neon

Neon's digital account also has a free maintenance fee, as well as unlimited and free transfers. In addition, it is possible to make 3 free withdrawals during 30 days at Banco24Horas ATMs. Excess withdrawals cost R$ 5.90.

You can open your account through the institution's app. To do this, simply download it from Google Play or the Apple Store and fill in the form with your details. If you are approved, you will be able to make the moves.

In other words, you will be able to make payments, transfers, withdrawals, loans, investments, among other services. Furthermore, it is possible to request a Neon credit card (subject to credit analysis).

It is international with the Visa brand. Furthermore, there is no annual fee, and it has many advantages, such as the Vai de Visa Program, automatic debit invoice, among other benefits associated with the brand and the digital account.

Nubank

NuConta from Nubank is our third fee-free digital account option. It is exempt from maintenance fees, and there is no charge for transfers. Withdrawals cost R$ 6.50 per transaction carried out at Banco24Horas ATMs.

To open your account, simply access the bank's website or app and fill out the form with the requested information. If approved, you will be able to make withdrawals, transfers, loans, investments, payments, among other transactions.

It is worth highlighting that the money that remains in the digital account yields more than 100% of the CDI, that is, it has a higher yield than savings. This is a big differentiator for the account. Furthermore, you can request the purple card, that is, the Nubank credit card (subject to credit analysis).

It is international with the Mastercard brand. Furthermore, it has no annual fee, and offers many advantages, such as the Mastercard Surpreenda Program, contactless payment and the Nubank Rewards Program (optional).

How to apply for the Nubank Card for negatives

Find out right now how to apply for the Nubank card for negatives, the roxinho without annuity that has fallen in love with Brazilians.

Inter

Banco Inter is our first fee-free digital account option. Through it, it is possible to make Pix, transfers and withdrawals for free. Furthermore, there is no maintenance fee charged.

To obtain your account you need to download the bank app from Google Play or the Apple Store. Then, fill out the registration form so that your request can be sent for credit analysis.

If approved, you will be able to make transactions on the account, such as transfers, withdrawals, payments, loans, investments, among others. It is also possible to request your Inter credit card (subject to credit analysis).

It is also important to mention that the card you request has the Gold variant, to obtain the Platinum or Black version it is necessary to upgrade your digital account. This financial product is international under the Mastercard brand.

It also has many advantages, such as contactless payment, zero annual fees, Mastercard Surpreenda Program, Cashback Program, among other benefits associated with the digital account and the brand.

How to apply for Inter credit card

Do you want to know how to apply for an Inter credit card? Then read our text and find out!

type

Digio is a very versatile digital account option, which seeks to attract a customer profile with lower credit expenses and even restrictions on CPF. But at the same time, it seeks customers who are looking for all the practicality of a card with a digital account.

Thus, the Digio digital account, in addition to being free, also offers a credit card for users, is also exempt from annual fees, and does not even have a minimum monthly spending limit.

So, among the good advantages of Digio to be among the digital account options for negative people, we can list:

- There is no redemption fee if you need a new card;

- No revolving interest charges;

- Exclusive Digio store with discounts for credit card customers;

- It offers the security of the Visa Gold flag, the most accepted in stores around the world.

- Optional Livello points program that allows discounts and free purchases on partner products, which costs 5 reais per month plus 1.5% of your invoice amount;

- Free Digio account with no administration and maintenance fees;

Digio is a good option among digital accounts for negative people if you are looking for a digital bank and zero paperwork. In other words, your credit card and digital account with all the practicality, benefits and security!

BMG

The BMG digital account is a new proposal from the bank, following the general global trend of financial institutions. This way, the customer has many more advantages, practicality and no bureaucracy!

Because the digital account’s slogan is: “The free digital account that helps you save money”. And the account has everything, but there are no fees to make it even more attractive for you! So, yes, one of the digital accounts for negative people that can offer you everything that the traditional format offers, with the advantages of a request process and other transactions, completely online!

In this way, BMG bank seeks to attract new customer profiles, in addition to its traditional audiences of retirees, pensioners and public servants. And the BMG digital account is not far behind in terms of benefits and technology, achieving its objective of entering this new digital niche.

Because with the possibility of doing everything online through the bank's digital platform, and also through the BMG app, it will be much easier to manage your financial life, right?

In addition, the BMG digital account has a series of discounts and fee exemptions on its banking services. There are also options to change your credit limit, make investments and have an exclusive benefits program for your account holders.

BMG account benefits

Therefore, in general, the benefits of your digital account will be:

- Completely free account with 100% online application;

- Less bureaucracy and more agility to open your digital account;

- You can also make unlimited and free transfers, both to other accounts at BMG bank and to accounts at other financial institutions;

- And you can make free and unlimited withdrawals at ATMs in the Banco24Horas network;

- In addition, you can count on benefit programs such as Poupa pra Mim and Volta pra Mim;

- Finally, your digital account gives you the option to start making safe investments with guarantees of better returns in fixed income, with zero brokerage fees.

Therefore, anyone who decides to open a digital account at BMG bank will hardly regret it, as it will be a service that values ease, practicality and good quality.

How to apply for BMG card for negatives

The BMG credit card for negatives is a card that offers ease of approval and can be personalized. Find out how to apply here!

About the author / Aline Saes

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Reseller: how to make money by reselling products?

Check out all the main reseller programs in Brazil and conquer your financial freedom with them. Choose one now and be a reseller!

Keep Reading

How to make money selling food? See the best options!

Check out the top ideas on how to make money selling food and find out what you need to get started.

Keep Reading

Discover the Digio Personal Loan

Discover the Digio personal loan, completely online and paid in up to 24 installments! Check out more about it, its features and advantages.

Keep ReadingYou may also like

How to open a Millennium Serviços Mínimos current account

The Millennium bank Minimum Services current account allows you to access all the banking services that are essential for day-to-day finance management and has a very low maintenance fee. See here how to make your own.

Keep Reading

Saving for Retirement: It's Never Too Early to Start

Have you started saving for retirement yet? Know that the reservation must be made from the beginning of the career so that you can invest the money and enjoy your income. So check out our tips for good long-term planning!

Keep Reading

How to Apply for the Inter Bank Card?

Find out now the step-by-step process to apply for your Banco Inter credit card. Read the instructions and choose one of the ways to order yours.

Keep Reading